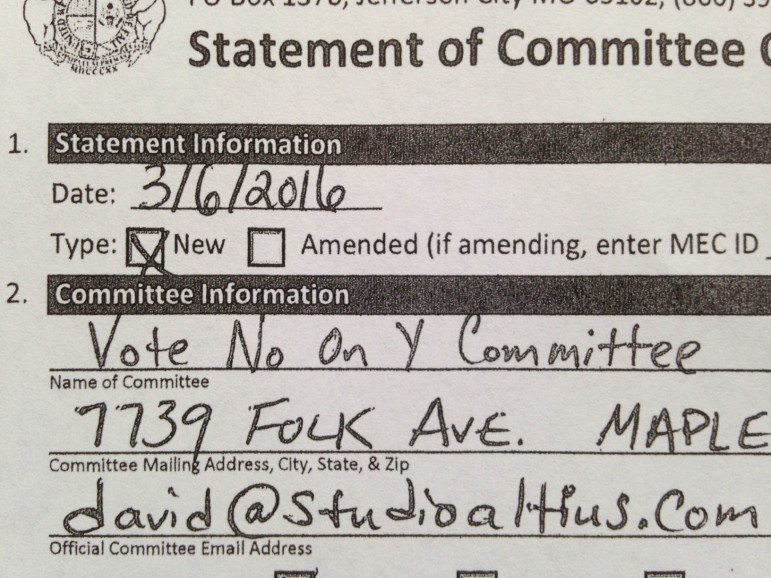

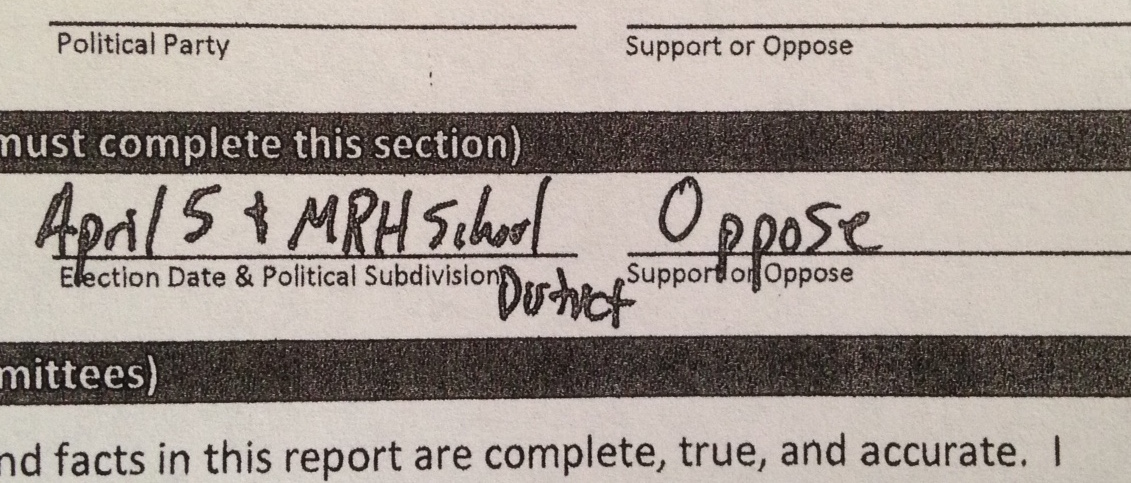

The ‘Vote No On Y’ committee filed with the Missouri Ethics Commission at the St. Louis Election Commission on March 10 — too late for a 40 Day Before Report (40 days before the April 5 municipal election) so contributions or expenditures aren’t on record yet.

What is on record, is that David Cerven, Maplewood Ward 1 city council member, is the treasurer of the committee. Its purpose is to oppose Proposition Y, a tax increase to support the MRH School District, in the April 5 election.

See also: Maplewood councilman, treasurer of ‘No on Y’ further explains his case

“The school district needs to be supported, obviously,” Cerven said Thursday. “We’ve got a great school district, pretty schools, I think it’s all really good. But I feel like in looking at the budget and looking at what they’ve been doing — the size of the tax increase based on the size of the tax increase they did just a few years ago — is pretty substantial.

“It would be a lot for the resident of Maplewood that might have things a little bit tighter for them. Ultimately, I think there’s a balance between how much money is given to school districts through taxes and what’s responsible for all the property taxes,” he said. “A balance can be found without making such a hardship for as many people, as long as things stay fair.”

Cerven said he knows some won’t like his opposition of Proposition Y. “I’m just trying to get people to realize, this is quite a bit,” he said.

See also: Pro-Proposition Y: financial report, MRH board votes to place Proposition Y on ballot

Vote No on Y. With the funds spent per student, MRH School District can continue providing a great education to our children and if not then a change at the top is necessary.

I, too, have been curious why there seems to be no public opposition to Prop Y. Regardless of whether one agrees with Mr. Cerven, isn’t the core function of democracy to have at least two sides to an issue? There is such a thing as loyal opposition, and someone shouldn’t have to suffer personal attacks because they are on the other side. Every yard sign I see is a “yes” vote; and judging by how yard signs seem correlate with election results in Maplewood, I’m sure that Prop Y will pass. The “vote no” campaign is not proposing something horrible; they are simply exercising their right to oppose a tax increase AND foster a public discussion. And we are lucky to have public, thoughtful responses from officials such as Mr. Mitten.

That said, it seems some of the public ire stems from a steady trend of property tax increases in the last few years. For example, the ECC and then the firehouse. These two might not be related in many ways, and they were put forth by different entities, but the apparent lack of coordination between municipal and school board entities puts the citizens in a sometimes tough position: two governing bodies asking for more revenue at about the same time. When we, working families, are just now starting to recover from 10+ years of stagnant wages, higher taxes can be a bitter pill that offsets even the smallest of gains. It’s a great accomplishment that MRH has such a stellar school system when you compare median incomes in the area, but at some point we might need to consider other revenue sources (e.g., entertainment district sales tax).

Mr. Cerven is not just a private citizen heading an opposition to a tax increase; he’s a public official. And for that reason, he would also bear some degree of responsibility for any “lack of coordination between municipal and school board entities” here. Moreover, Mr. Cerven supported the firehouse bond. In that sense, it’s a little rich for him champion those who might be straining under the financial weight of another tax increase. One other thing to keep in mind is that in 2013, he and the council also rejected the rezoning of a property across from the ECC that would have alleviated some of the overcrowding in that building. Could the school board have possibly waited a few more years for the Prop K bond to build a new preschool if the council had been more supportive of the school district? I guess we’ll never know.

Talk to your friends in Florissant and Hazelwood if you want to know what happens to home values if public schools deteriorate. Or speak to them in person at their new home in St. Charles County.

most of you who bought your house in the 90’s or early 2000’s taxes aren’t even assessed to the value it should be. in the process of buying another maplewood home, the taxes are way off in most homes. you should worry more about the county reassessing your property than the prop that is resulting in you properly values going up like crazy.

There needs to be a stopping point. Since 1996 my taxes have more than tripled! Unfortunately the school system was inferior in early 2000. The middle school couldn’t address the needs of advanced students and in their words “we are focusing on the students who are behind and not the students who are advanced ” That one statement forced us to leave the district and go to private schools. Meanwhile I have supported every tax increase since and I do believe they have turned things around. I understand it was just bad timing for my kids and a district in transition but enough is enough. At what point does your tax burden out weigh the benefit…now.

The benefit of owning a home in a great school district? Does that make the tax burden a little easier to bear?

My taxes have also tripled since I bought in 1991; the value of my house has also tripled. My son and his friends are seniors and taking AP courses, in leadership positions and meeting challenges in every kind of school competition. With the programs in place, including those from his earlier grades, he has been accepted to all the colleges to which he applied (SLU, Webster, Bradley, Drake, Rockhurst, Truman and two schools in New York) and received substantial academic awards. I fear that without the continued commitment to the schools, future graduates will not have the same opportunities so critical to college applications and acceptance. That is why I am voting YES.

I’ve lived in the school district many years, and as a parent, I’m incredibly impressed by the continued transparency by our school district.

The Sunnen development is not a T.I.F. but a tax abatement. The school district has no control who the city council gives tax abatements to. It’s my understanding this development is primarily high-end, one bedroom apartments, marketed towards single professionals. The impact for enrollment should be minimal.

Regarding the property acquisition, I asked one of the board members. Those purchases were made with funds from the 2010 Prop Y, which was approved by our community.

As for numbers, we are a growing district, just going into the school to pick up my children, I personally see the buildings are budging with kids. I urge any resident who has questions to reach out and call the school, speak to a board member, or even take a personal tour. We are a great district and I urge my fellow residents to VOTE YES ON Y and keep our schools strong!

I don’t think the school district got any funds from the 2010 Prop Y until taxes were paid for 2010. These bills aren’t even sent out until Nov. That being the case how did they purchase these 11 properties for over $800,000.00 before they received it?

I agree with you, Sandra. The buildings are bursting with kids- I know many special educators have to share rooms because there is simply not enough space.

The tone of some of the anti Prop Y comments appears to suggest that the school board is trying to “pull the wool over our eyes”, or there are different ways to get money, and/or they are somehow misusing or hiding funds. I’m certainly not an expert, but I don’t believe the school board would go to the trouble of asking an extremely diverse set of community members for more money unless they had no other choice. Let’s be honest, asking for more money is no picnic!

On another note:

To my long time MRH residents, please consider voting yes for Prop Y. Remember years ago when the school board didn’t ask as often to raise your taxes? How much was your house worth then? How much is your house worth now? I would guess it’s worth considerably more than when you bought it- and you have the school system to thank for it.

If I remember correctly this gentleman’s photography business used to be used by the school district for a annual student photos. There was some sort of falling out and I heard that Mr. Cerven was very unhappy with the district over being replaced by another photography studio. I wonder if he would start such an opposition to school funding if he was still getting business from them. Very disappointing action by a local business owner and city official, he certainly won’t be getting any business from MRH families anytime soon.

Voting no. Enough is enough.

LETS GET THE REAL FACT OUT THERE, and STOP THE SMOKE AND MIRRORS!!!

I found it interesting that I was told (by a City Official) that the school board sat on the TIFF COMMISSION and DID NOT oppose the TIFF for the new development on Hanley. This development includes new apartment. These new apartments will bring new students into the district, but NO NEW REAL ESTATE TAX REVENUE for the district.

If memory servers me , when QT wanted to move, MRH school board met numerous times with the Council members. This was because of student safety concerns, the loss of these tax revenues should have also been a concern.

My question is WHY didn’t the MRH School Board do it’s due diligence, and protest this TIFF. This TIFF will put a big burden on the district. Not only by bring more students but also a HUGE loss of tax revenue.

I guess it’s easier to put a Proposition on the ballet to raise taxes. The burden is then put on the same people that have given them TWO (2) TAX INCREASES in the past FIVE (5) years.

I can see another tax increase proposition a the near future. The apartments will be completed, tenants with CHILDREN will move in. This will increase the enrollment, in-turn having the MRH School Board asking for more money yet again.

Another interesting FACT is that in 2010 the School Board sought and got a tax increase. In that same year (before any of the of that tax increase was received the School Board SPENT over $800.000.00 on property. Funny that they had $800,000.00+ to spend on property BEFORE they received one penny in the requested tax increase.

They keep siteing the student huge increase over the last 10 years, well it’s ONLY BEEN 6 YEARS since the last TAX INCREASE. The increase in students since the last increase is no where near the 30.8% they keep stating, but more 18.6%.

Let us not forget about the tax increase by St. Louis County, Jake Zimmerman, on the last assessed increase of “Land” valuation by 20% to 60%.

Dear Harold,

The city official with whom you spoke gave you some very bad information. The last tax abatement given by the City of Maplewood to Sunnen Redevelopment for the apartments was not a TIF, but under a different statute which gives the school district NO vote on whether to pass the abatement. Therefore, if you have issues with this action please direct your ire towards the City of Maplewood elected officials, and not punish the children of this community for a decision over which the MRH Scool District did not have a vote.

I also want to clarify your statement on past tax levies. The last operating tax levy sought by the District and graciously supported by our taxpayers was in 2010. Last year the taxpayers supported a bond levy, which will allow us to build the addition and make renovations to the Early Childhood Center to accommodate the significant increase in enrollment. Now the District needs the funds to provide additional teachers for this increase in enrollment and to maintain the programs that have caused MRH to be ranked one of the top school districts in the state. Without the increased enrollment I doubt there would be a need for these additional revenues. But to maintain the quality programs that made MRH great we must look to our citizens for their support.

As a longstanding member of the MRH School Board, I, as well as my fellow Board members, am willing to discuss the status of the district and the need for this levy. Please feel free to contact me by email at [email protected], or my home phone of 314-644-0919, or any of us through the contact information on the District website.

Nelson Mitten

MRH School Board

I want to know how the board was able to purchase over $800,000.00 in property BEFORE receiving a penny of the 2010 Prop Y? How many of these purchases was for PARKING LOTS? $800,000.00 would pay for how many teachers for how many years? The properties and date of purchase can be found at http://revenue.stlouisco.com/IAS/. How many of these purchases was for PARKING LOTS?

OK, so the board had NO vote, on the tax abatement, same as they had NO vote on the QT move? Did the board do it’s DUE DILIGENCE and even meet with the City Council to try and oppose the tax abatement.

Mr Mitten,

No, thank you. This OPEN FORM works just fine.

I would like a reply to my questions above.

I voted for Prop Y in 2010, and did a home refi in 2011 to keep my house payments around the same. I also voted for the new Fire House and Prop K, both time redoing my home owners insurance to try and keep payments the same.

Schools already account for the biggest part, of both my Real Estate and Personal Property TAXES. There just comes a time enough is enough, and people are maxed out.

Thanks,

Harold,

I’ve voted for every tax increase to support our schools the last 25 years. But enough is enough. Compared to other districts our taxes are already higher. MRH needs to reevaluate their budget.

Mr. Cerven, have you attended any town halls about the proposition, looked up school board information that others have found to be very transparent, attended school board meetings? I am glad you think the buildings are “pretty”, but, as maintenance and repairs are deferred, they will not stay that way, costing the district more in the long run. What are you solutions for a school enrollment that is bulging because more and more families are moving in to the area for the school district? Do you have a response for parents whose children are in classrooms with 28-30 children? I remember sending a letter to you and others on the council about the Quik Trip construction and never heard from you. I found it ironic that you weigh in on this, but you had no need to address people about that issue.

Niche High School Ratings: Clayton-1st Ladue-3rd Brentwood-24th MRH-33rd. St. Louis County school districts’ tax rates: Clayton-$3.85 Ladue-$3.53 Brentwood-$4.68 MRH-$5.59.

Hi Rachel. Your information is correct but each statistic tells a different story. First, we should be proud of our HS that it is now ranked 33rd in Missouri by Niche. The school district as a whole is #20 in the state. That’s great! The improvement in the district can be traced to good people and good investment by the community. And we all enjoy the benefits of the improved district.

Now, when comparing nearby district tax rates, the fact is that Clayton/Ladue/Brentwood have much higher property values than MRH as a whole. Ladue has million dollar homes to increase property tax revenue. So they can get by with smaller rates. Webster Groves has some high property values but a lot of low ones as well, and they have a higher tax rate than MRH.

A recent NextSTL blog post discussed how our St. Louis communities are headed towards issues with school budgets (if not already there), because the cities themselves are chasing tax revenue instead of property revenue. You can see this in play with Wal-Mart, Menards, TIFs, etc… The city wants sales tax, the schools need property taxes. And it would seem that we need to bring the two together.

Clayton:

Median household income: $64K (per Wikipedia)

Median home value: $567K (per Zillow)

Ladue:

Income $141K, home value $816K

Brentwood:

Income: $60K, home value $187K

Maplewood:

Income : $29K, home value $142K

It’s hard to figure Richmond Heights since you have segments of that city that include Clayton and Ladue schools as well as MRH.

Once again this all comes down to our horribly fragmented metro area with so many redundant items. We wouldn’t be wasting money on duplicated services for government, police, fire protection, school districts etc if Maplewood, Richmond Heights, Clayton, Brentwood, Rock Hill and/or Schrewsbury could merge into a reasonably sized suburb instead of the little fiefdoms we have now.

We also wouldn’t have the TIF development giveaways and shopping center battles we have now. Just look at Home Depot in Brentwood, Lowes in Maplewood and Menards In Richmond Heights all stealing tax revenue from each other and handing over to their parent company.

I agree with you in terms of cannibalizing businesses because of all these “fiefdoms.” I would like the County to have more ability to stop local municipalities from taking tax revenue from each other (a la Home Depot, then Lowes, then Menards). But I would not want a school district that large. Aside from the stellar teachers and administrators we have, one of my favorite parts about being in the MRH school district is how walkable all the schools are to most residents. In a much larger school district, our children would either spend more time on the bus or in the car. Depending on how the district is structured (San Francisco comes to mind), my child might be assigned an elementary school all the way in Brentwood. Yes, by car it’s only 10-15 minutes, but we moved to Maplewood for its walkability, including to the schools. In my opinion, large is not necessarily better with schools districts.

Good to know who not to do business with.

You won’t support his bussines because he has some legitimate concerns about the hardship this might place on many of our residents? What a silly comment to make.

Yes, it’s pretty simple. And I’ll also contribute to the campaign of anyone who opposes him in the next election. Taking public positions has consequences for elected officials.

Are there vote No signs? Haven’t seen any and would like one.

Me too.

Me Three

Me not. Vote yes!

Comments are closed.