The Maplewood Richmond Heights School District is asking voters to approve Proposition K in April, to be used to build a new preschool—ultimately making more room in the elementary school and eliminating the waiting list for the preschool.

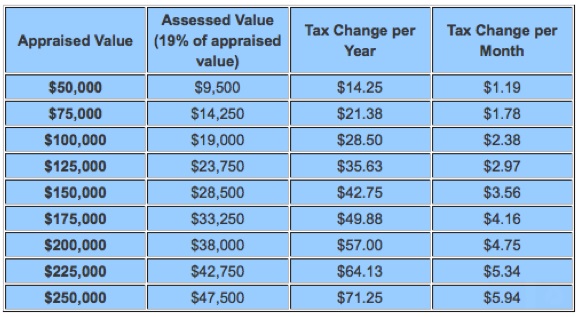

The school department has published this clarification of how much the tax would cost home owners:

The MRH bond issue (Proposition K), if approved, would result in a increase $0.15 per one hundred dollars of assessed valuation from $1.20 to $1.35 per one hundred dollars assessed valuation of real and personal property, which approximately equals a $28.50 tax change per year for each $100,000 of appraised valuation. Click here for a table illustrating the annual cost to a property owner, based on the appraised and assessed value by St. Louis County.

See also: MRH communications director responds to bond questions, Homes ‘sold immediately’ in 2014 in MRH district: broker

Subscribe to the 40 South News daily newsletter

Taxing Authority Tax Rates (multiply x assessed value) Resident Realty /Commercial Rate

Personal Property

Bayless 4.7682 4.8548 5.4371

Brentwood 4.6495 5.1474 4.4068

Maplewood 5.5500 5.5500 6.1158

Clayton 4.1027 4.6085 3.99

PP tax Now, 6.1158, new 7.4658. per 100

Tell the truth please !!!

The majority of these properties were purchased after the community approved the bond issue, Proposition Y, in April 2010 to address safety and traffic concerns by expanding the parking areas at the Middle/High School campus. Other noted addresses represent the actual campus, or property purchased to house expanding student programs (such as Student Success Center, New Vision, Joe’s Place, etc).

1 – 2605 S Big Bend Blvd. (MS/HS parking lot, purchased with 2010 bond issue)

2 – 2007 Alameda Ave (the Elementary campus parking lot)

3 – 2813 Burgess Ave (adjacent to ECC campus)

4- 2549 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

5- 2551 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

6- 2553 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

7- 2555 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

8- 2556 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

9- 2562 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

10- 2564 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

11- 2565 Florent Ave (MS/HS parking lot, purchased with 2010 bond issue)

12- 2544 Gerhard Ave (MS/HS parking lot, purchased with 2010 bond issue)

13- 2548 Gerhard Ave (MS/HS parking lot, purchased with 2010 bond issue)

14- 62552 Gerhard Ave (MS/HS parking lot, purchased with 2010 bond issue)

15-2554 Gerhard Ave (MS/HS parking lot, purchased with 2010 bond issue)

16- 7327 Glades Ave (Elementary campus, student’s field area)

17- 2511 Oakland Ave (Joe’s Place)

18- 2555 Oakland Ave (MRH Student Success Center/classrooms)

19- 2556 Oakland Ave (MRH New Vision Center/classrooms)

20- 2556 Oakland Ave (duplicate of #19)

21- 1800 Princeton Pl (the Elementary campus)

22- 2014 Princeton Pl (the Elementary campus)

23- 7539 Manchester Rd (the MS/HS and Central Office campus)

I’m curious about the land acquisition MRH talks about on their website. It falls under Part 1 of Proposition K. I’m assuming this is at the ECC where they plan to build a new preschool. Does anyone know what land are they planning to purchase? While I am for Prop K – I am not a fan of them taking single-family homes. I believe they purchased a single-family home by the ECC a while back and the City would not rezone the property.

Although I do not have any children, I am proudly going to vote yes on Proposition K. This will be a great benefit to our community that I love so much.

The appraised values, and subsequent assessed values, for homes (which contribute to property taxes) have been rising since I bought my house in 1991. My house has tripled in value, not just because of the upkeep I have been able to maintain, but because this area is now a destination area. I admit that does me no good unless I sell, but the point is I don’t plan on selling because the MRH area is a wonderful place to live. And it started with the tireless effort to make the schools competitive. People cannot turn their head to the needs of the district simply because they no longer have children in the district. Those students are working in the grocery stores you frequent, the restaurants you may go to, and the retail stores throughout the area. They represent the Maplewood-Richmond Heights area, and they represent us well. At the well-attended potluck dinner last night, Kevin Grawer, principal of the high school emphasized the point that the accomplishments of the high school students was dependent on the efforts of the ECC principal, Cyndi Hebenstreit, followed by the elementary principals and the middle school principals. Their combined efforts are needed to facilitate growth in students (in academics, in music, in athletics, in leadership, in service to the community). This bond is not just a pre-school question; the objective is to have the ECC now include 2nd graders so that the elementary school is not encumbered by overcrowding that impacts everything from teacher:student ratios to lunch and bathroom schedules. I taught in the well-regarded Kirkwood High school, and now substitute in the MRH High school. Our students, too, are challenged by excellent, forward thinking teachers who also double as mentors for extracurricular clubs that further enrich the educational experience and readiness for college, technical schools, apprenticeships,etc. Students are able to forge relationships with teachers and maintain that bond across their entire school career because of the commitment of the teachers AND the administration’s commitment to size of the classroom. Any questions on this thread can be answered by administration, so I recommend attending any forums that are being scheduled or call a board member. Trust me, as a Special Education teacher I have taught in districts where the value of homes eroded as the school districts eroded in viability.

Agree with you Janice, well said. My wife and I moved to Maplewood in ’98 from an apt in Chesterfield, we were young with no children. We said if we didn’t like it we would move in a few years. We are still here. We have the means to live elsewhere, but choose to live here. Even though our children, now in high school and middle school, attend catholic schools, my wife and I have voted yes on every tax increase that benefits the MRH district. Our property taxes have tripled over the years. I am not complaining. I know where the money is going. Listen, I am a fiscal conservative, I don’t like wasted tax dollars. I’m sure there is at some level waste in the district, but on the net, the stronger district is a major positive for our little burg. The passing of this bond will further emphasize the fact that our community is putting education on a pedestal, which we will all benefit from in the long run.

Per the Tuition Schedule on the Early Childhood Center website.

Requirements: You must live in the MRH School District.

I’m sorry that this don’t post as it is typed with the spaces between the list. I’m sure some will have a hard time reading it.

This is what I found on the St Louis County Real Estate Information page. It looks like the Maplewood Richmond Height School District owns 23 different properties. Of those 23 properties 11 have been purchased since the last SCHOOL TAX INCREASE. This come to a TOTAL COST to Maplewood Richmond Heights Tax Payers of $1,052,500.00. I know that there was also MAJOR construction to the Building of the Early Childhood Center that was just completed in the past year and a half.

I don’t recall what the tax increase was based on in 2010, I DO KNOW my Accessed Value didn’t go up but MY Real Estate Tax went UP $239.64 in 2010.

Date Purchased Priced Paid Real Estate # Address

1- 2-06-2010 $110,000.00 21J510080 2605 S Big Bend Blvd.

2 ?? ?? 20J311660 2007 Alameda Ave

3- 10-30-2012 $ 5,000.00 21J140353 2813 Burgess Ave

4- 7-28-2010 $ 52,500.00 21J510431 2549 Florent Ave

5- ?? ?? 21J512543 2551 Florent Ave

6- 8-03-2006 ?? 21J512554 2553 Florent Ave

7- ?? ?? 21J510299 2555 Florent Ave

8- 8-13-2010 $107,500.00 21J510321 2556 Florent Ave

9- 10-12-2010 $175,000.00 21J510277 2562 Florent Ave

10- 10-12-2010 $175,000.00 21J510178 2564 Florent Ave

11- 12-3-2001 ?? 21J510233 2565 Florent Ave

12- 4-06-2011 $ 80,000.00 21J510442 2544 Gerhard Ave

13- 3-23-2011 $125,000.00 21J510387 2548 Gerhard Ave

14- 6-11-2010 $ 72,500.00 21J510332 2552 Gerhard Ave

15-12-03-2010 $150,000.00 21J510266 2554 Gerhard Ave

16- ?? ?? 20J311642 7327 Glades Ave

17- ?? ?? 21J421056 2511 Oakland Ave

18- ?? ?? 21J420396 2555 Oakland Ave

19- ?? ?? 21J420341 2556 Oakland Ave

20-Early Childhood ?? 21J140409 2556 Oakland Ave

21- ?? ?? 20J311651 1800 Princeton Pl

22- 7-02-2010 $100,000.00 20J311682 2014 Princeton Pl

23-High School ?? 21J231415 7539 Manchester Rd

TOTAL-2010-2015 $1,052,500.00

Thanks for looking that up David, and thanks to all the comments… nice to not get completely slammed for having thoughts!

And David, this was several years ago, I recall after it happened looking it up in the Post Dispatch that same year with one of their annual reviews of schools. At that time, I beleive there were only 2 districts that had higher rate than Maplewood in all the areas the listed in the paper, which were dozens. I guess others have caught up in those years, but being near the top of that list still isnt a great thing. I am admittedly not great with numbers — where would be be on this list (of last years rates) if this increase passes?

I wonder why they aren’t looking at increasing the costs to be closer to the surrounding Pre-K’s to help offset that cost? I beleive (and understand I could be wrong) but the Pre-K is open to outside of the district…If I am correct, and as the Pre-K has a very good reputation, it would be interesting to see how many from outside are simply taking advantage of a good program for a cheaper cost? Unfortunately, from the numbers posted previously (which I can’t find now), year to year, though the lower grades are filled to the brim, the JR & HS lose students as parents seem to pull them out as they age.

I understand that the pre-K program gives priority to district families. It remains to be seen if the larger class sizes remain into the later grades. My daughter, who has been in the district since Pre-K, is now in the 7th grade and her class has size has maintained.

Hi Babs. The Bond in question doesn’t really have anything to do with funding the Pre-K, but rather adding space to the district as a whole. Adding a Pre-K building frees up space in all the other grade levels.

Ian, you are correct in saying that the bond is only for a new structure. But Babs has a valid point and I believe those who use the voluntary school should pay a heavier fee.

The plan to keep classroom sizes smaller and meet other goals by finding a better space for Pre-K is a great idea. It isolates the problem to one area which keeps cost down. It is also cheaper and provides more flexibility in putting a 3 or 4 year old in a space for learning than older kids. But at the same time, the downside of the plan is that the fix to this bigger problem is to make a decision on the Pre-K, which is not a necessity but a luxury (albeit one most people want to have available especially since MRH has a strong reputation).

I believe the rationale behind Babs post is that if our Pre-K costs are much lower than those surrounding areas, why not raise tuition some and have part of that money that is in excess of operating costs go to paying off the new location? Even if 130 fulltime kids paid an extra $1,000 that is $130K towards the bond a year. While it is only a small percentage of the $6MM, it will eventually add up (over 10 years it would be $1MM/15%) and be a show of good faith to the community that those who benefit most from having the school are paying a little extra.

Joe S. and Babs, i think that what you’re saying makes sense. We charge more to non-members or residents who want to use the Heights or Maplewood Pool. I wonder why the ECC doesn’t charge more tuition for non-MRH residents who use our preschool? Their taxes aren’t subsidizing the school, so they should make up the difference.

In light of the long waiting list, I’m surprised that we even allow non-residents. Why is it problematic to limit a public preschool subsidized by taxes to only those who live in the communities who pay taxes? Registering for preschool in MRH is a very stressful process because of the waiting list. Ask anyone who has done it. If you want any spot other than full time, it’s hard to get the spot best for your schedule. I’m honestly somewhat surprised and frustrated that non-residents can apply and send their kids when we have such a waiting list.

Jane, I agree with your concern. My husband and I could not get our children into the ECC. There were only a few openings on odd half days. One of my sons started attending the ECC in kindergarten, and when he headed to MRHE, I thought, “If only the kids could stay here through 2nd grade.”

I am thrilled that the district recognizes that 2nd grade really is still early childhood. In an age of questionable media directed at children, why not give kids the gift of another year in such a nurturing surrounding? Also, given the skills taught, it makes more sense for teachers to do a 1-2 loop instead of a k-1 loop.

It’s too late for my family to get the full MRH Pre-K-12 experience, but I am proud to support that for other families. My hope is that some of those slots will be used to expand Head Start. I also hope that the district is carefully monitoring these posts, because there are great ideas here and concerns that need to be considered.

The preschool is not open to nonresidents. Those who attend preschool must be residents of Maplewood or Richmond Heights and must pay tuition. You can see the requirements for registering a student for preschool here: http://www.mrhschools.net/userfiles/files/school-ecc/2014-15_Prek_fee_schedule.pdf

The preschool is not open to nonresidents. Those who attend preschool must be residents of Maplewood or Richmond Heights and must pay tuition. You can see the requirements for registering a student for preschool here: http://www.mrhschools.net/userfiles/files/school-ecc/2014-15_Prek_fee_schedule.pdf

Be grateful that you don’t live in the Fort Zumwalt district where they are proposing a $.48 tax increase. Great schools make a great community! We attended a meeting last week at the school district about the proposed bond. There were a total of maybe 40 people in the room which included every school board member, several teachers and every principal, both superintendents, one business owner, and only 8 parents. Get involved in your community! Attend meetings, understand the issues. Our teachers and administrators love this community and work their tails off to make the schools a great learning environment for our kids. Let’s help them work in the best conditions possible.

I have multiple children in the district and do a pretty good job reading correspondence from administrators. This is the first I have heard of this meeting. I imagine it couldn’t be announced before the bond was announced, so perhaps it was just short notice that didn’t enable people to attend? Or not enough getting the word out? I wish I would have known. I just looked and don’t see the meeting listed on the January newsletter from our principal.

Jane, I think it was a Long Range planning meeting, so maybe it was not open to the public. I am sorry if I mis-represented that. BTW, great chance to talk to fellow parents tonight at the 3rd Annual Parent Potluck at the High School at 6:30pm.

As a side note, I think it is important that everyone in this comment feed understand that the ECC isn’t only a preschool (for everyone saying preschool isn’t a necessity). The ECC has Kindergarten and First Grade. It is part of the MRH Elementary program. So it is very necessary, even if you think preschool isn’t vital, you can’t possibly think Kindergarten and First Grade aren’t vital.

I am shocked by some of the responses here. It’s blowing my mind that people are getting up in arms over what would be such a small increase in taxes. 6 extra bucks a month should not break the bank for anyone.

It doesn’t surprise me in the slightest, and even as a supporter of the bond, I do think the onus is on the school administration to do a good job of explaining to the public why this is important. I will vote yes, but even I have some questions, the foremost being – in five years, will we be in the same position? Is this preschool plan far reaching enough to accommodate the district 5 or 10 years down the line? I know that no one has a crystal ball, but each subsequent bond is going to be a harder sell for voters. In theory, yes, six dollars a month equals a monthly sandwich at Jimmy John’s, but you have to look at it from the perspectives of those other than yourself, of those who perhaps have no actual connection to the schools. Plus, if one already feel like one’s taxes are too high, each increase, however small, will rub someone the wrong way.

Some here have clearly indicated that they will never vote “yes” on a school bond, regardless of the demonstrated need. Others have asked perfectly valid questions that need to be answered. I think in large part the bond will succeed or fail based on how they proceed in the next few months and how transparent and successful they are at articulating the need for this new building. And the district can’t just assume that all parents will vote yes to this either. That Lincoln Douglas has children in the ECC and is still unconvinced shows that more needs to be said to persuade the voters that this is indeed necessary.

I am sad by some of the comments that have been posted. First, the school did not make the rules on raising money. The ONLY way the school can raise funds to give our children a better education is through property tax. The city can raise funds through sales tax, permits, tickets, etc. I voted for the Fire House also but was always concerned that the city council did not ask for a “no tax increase” bond…they could have, and should have but they didn’t. One of the main factors why our city is great is the schools, People move here cause of the school, period. If your not, you should be, proud of our schools and how far they have come and how far our children have come. Again, the city can raise money with sales tax, permits and speeding tickets – the school can ONLY raise money from us as a community. They need your HELP.

They have my support!

If “50% of its students are on reduced lunch” & “has a significant number of Head Start spots” THAT is costing the district more money to support rather than going to education. And yes, children are going to our schools that do not live in Maplewood…they live on my street. Who is paying for the free breakfast & lunches??? Over taxed taxpayers. I’m on a fixed income. Everything is going up except my earnings. I did support the fire house. I did support the lateral sewer increase. I will not support this school district farce. If I say yes to everything, I won’t have a paycheck! No, big NO!

The free and reduced lunch program is a federal program paid for by federal funds. Head Start is a federal program that may also be funded by the state. Perhaps 20% comes from local funds. If you are concerned about how you spend your tax dollars, consider whether you’d like the money to go toward prisons or preschool. There is a direct correlation between lack of education and incarceration.

I think of all of this as an investment. Education is one of the greatest factors in life success and in giving kids the resources they need to make positive choices. The federal government supports these programs because Head Start prevents deficits that can take years (and countless tax dollars) to overcome. It also recognizes that kids can’t learn if they’re hungry. Ultimately, the goal is informed, educated, working citizens. For the most part, this works.

Well said!

I second the “Well Said” comment. Now that you are better informed…how will you vote?

I’m confused. If they live on your street, how do they not live in Maplewood? Regardless, if you know of non-resident students, you could certainly contact the main district office and let them know. I agree with you that this is not acceptable.

Here is an article from 2012 related to the retirement of former Superintendent Linda Henke, and how she turned around the school district.

“The middle school was on the state’s academic watch list. The district was flirting with losing full accreditation. The high school was surrounded by barbed wire. Doors with broken locks were chained shut or jammed with broom sticks. Science labs had no running water. Gangs used school walls for graffiti.”

http://www.stltoday.com/news/local/education/agent-of-change-retiring-from-maplewood-richmond-heights-schools/article_b57146b9-fc75-56bc-8d40-0daedaec1a0c.html

In 10 years my taxes have doubled. A brick two bedroom that needs to be remodeled, and taxes are right at $2,500. I think that is way too high. I own property in a number of places, and none are at this rate.

I’ve lived here for 15 years. When I first came to STL, Maplewood was, for the most part, an undesirable place to live and people certainly weren’t fighting to get into Richmond Heights. The turning point was the school district improvement. It took a lot of hard work and it can’t be taken for granted. An average $45-$50 per year investment on the part of homeowners will only increase property values that are already on the rise. This community is stronger because of the schools. All other improvements were possible because they paved the way. Long term residents, who are willing to be honest, will tell you the same thing.

This is a great point, and one that isn’t immediately seen in the ‘property values’ discussion. In the late 90’s, the home I lived in was condemned. Downtown had a giant empty K-mart. The strip was nothing like today. And most importantly, the school was ranked lower and definitely looked down upon. Residents of Kirkwood, WG, would never have dreamed of moving to MRH. Even now others in the region battle their long held perceptions of Maple’hood’. A major factor in the turnaround of our community is the school district. If you value the changes in Maplewood over the last 20 years, then don’t try to give it back by not considering our schools important.

More taxes for Maplewood? Why was this not on the radar when we voted on the new firehouse? This is bad timing on the part of the school board. We just voted to raise our property taxes, and now they need more for something else. I live in a modest home, and almost $2000 (>75%) of my property taxes goes directly to the MRH school district. I personally know that overcrowding is an issue. I have kids at the ECC and we love it. But seriously, my taxes are already quite high. The people who want to pony up blindly either (1) are renters and don’t pay much in property tax or (2) pay their taxes via escrow and have never looked at how much of their tax dollars go to MRH already. The school board really should have timed this better.

You should consider yourself lucky to have your kids in the ECC. As the article said, there is a waiting list for the ECC. This is a program that any residents should be able to get into. And this is why we need to raise the money, so that all Maplewood-Richmond Heights children can go to our amazing ECC.

Why are we asked for tax dollars for a voluntary program that parents pay tuition for?

The benefit will actually be seen at the K,1-2 levels where the teachers will be able to loop with students that is more beneficial to them. Also at the elementary school, where the real problem of overcrowding exists. The real point of the building isn’t to get a new preschool, as it is to provide rooms in existing buildings that cannot be cost effectively expanded. Great question.

Jane and Mike, first, thanks for the good discussion back and forth about why to pay/not pay for this building.

What does it cost to attend the MRH Pre-K program? Any idea how it compares to other places?

I don’t buy the argument that the main purpose of the new building is primarily to alleviate crowding. It doesn’t give a good enough reason. You could cut the Pre K program until a better solution comes along and still have the same result. Pre-K is not a requirement. Parents who can afford MRH Pre-K and strongly believe in the benefits of Pre-K can pay to have their child attend elsewhere for one year.

However, what is concerning to me is that MRH is a financially diverse area (which is a good thing) and that Pre-K provides about 20 Head Start spots (according to Jane’s post). It is in the best interest of the community to provide support to these kids that may not otherwise attend Pre-K since it is not a requirement and they could not afford to attend elsewhere. But at what dollar amount?

With the tax, the average homeowner in the district would have to pay roughly $700 over 15 years to educate 20 students a year that may not go to Pre-K otherwise. This might be a fair price, but the school district has not done its due diligence in treating voters like intelligent beings as opposed to endless cash registers. They have not showed the numbers of why building new is necessary as opposed to using a different space. Pre-K students don’t need smart boards and high electronic gadgets to learn. They need blocks, crayons, balls, books and a structurally sound environment to play with these things.

MRH Pre-K is $6,300 per year (5 full days)

Ambrose Pre-K (WG district) is $8,200 per year (5 full days)

College School Pre-K (WG private) is $13,300 per year (5 full days)

Kirkwood Pre-K is $9,600 per year (5 full days)

Brentwood Pre-K is $9000 per year (5 full days)

Awesome, thanks Ian.

That is a decent amount of money when considering it is going towards a 3 or 4 year old’s education. At the same time MRH is significantly cheaper than other options and probably half what it would cost to send your child to day care (although day care would include summer).

Joe, I hope that someone from the district will see your questions and provide answers. It’s possible that instead of assuming that taxpayers are dumb, they may think they are better informed than they are. I don’t mean this sarcastically at all, so please, please don’t read it that way.

In the past 1.5 to 2 years, there have been public forums to seek suggestions about how to fix over-crowding in the elementary school. This year, a modular classroom was added to house two classes. I know of teachers who are meeting with students in what used to be storage closets.

The current preschool doesn’t use a lot of technology and I don’t imagine a new one will, either. It’s not part of the philosophy. Still, the building will have to be ADA compliant and at least wired so that the teachers have access to online resources.

As a certified elementary teacher, who spent 4 years also teaching preschool, I can tell you that quality varies widely from school to school. From the schools I explored for my children, MRH was highly competitive, and in fact, on the low side. For one of my sons in particular, I regret not starting him out at the ECC. Learning through the MRH philosophy and having access to educational interventions might have really given him a boost.

I used to not be an MRH supporter, but as a substitute teacher and parent, I have been amazed at what the teachers and administrators do with the resources they have. If anything, I would say that right now resources are tighter than people know and a lot is done with grant money. if that story’s not getting out, then the district needs to tell it.

If you ever want to meet me at the MRHE or ECC, I would be glad to give you a tour and share with you the changes I’ve seen and why I’ve changed my mind. Truly, i was one of the district’s toughest critics.

Have a great day.

I just want to add that the ECC is much less expensive than many other preschool options. Which you said, Anne. I just wanted to second that. 🙂

Because the tuition barely (if even) covers the costs of running the program. It would never generate enough money to build a new building. The voluntary aspect is certainly valid, but it has been proven that preschool for low income students is extremely effective in improving their long term educational success. For a district that has 50% of its students on reduced lunch, this is especially important. The preschool has a significant number of Head Start spots, twenty if I recall. This is also a strong indication that it is a necessary program in our district. In addition, people actually move to Maplewood and Richmond Heights so that their child can attend the ECC, thus increasing property values across the board. Finally, the building of the preschool will relieve congestion at the elementary school as well.

What about the extra cost on my personal prop tax? You never talk about this. Add them together and then you have the total cost of Prop K to the residents of the M-RH area !! Now let’s talk about the real cost and what a 75+year old resident, without children has to pay to keep their two bedroom, one bath home in an area that people move into, not away from. All I see is FOR SALE signs in my area. Sorry Katie, I don’t buy your story !

Something that some of the community members may not be aware of is the Tax Credit for Personal Property Taxes that may be available for some of our Maplewood and Richmond Heights Citizens. “The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. The actual credit is based on the amount of real estate taxes or rent paid and total household income (taxable and nontaxable).” I suggest visiting this website for more information. http://dor.mo.gov/personal/ptc/

I have lived in the MRH area for 20 years and have watched the growth of the school and community. I couldn’t ask for a better place to live. I will vote yes. This is a great investment in our community, our children and out future.

Susan, I loved that you provided Harold with an outlet to be able to afford his taxes, if he qualifies. It’s a testament to our district to not leave anyone out.

If the school district makes sure all the students live in the district ,we probably wouldn’t have a waiting list or over crowding

Can you provide some evidence for this claim? Hundreds of kids?

Anecdotally, I personally know of one case in which the mother was living with her parents in M’wood and moved out of the district but had the grandmother continue to take the child to the ECC. The school found out when the kid accidentally revealed that she had to use the highway to get to school.

You’re blaming the district for something that happens in all good schools. Of course, people want to keep their kids enrolled. The question is how MRH handles it. I’ve seen the district actively address this sort of issue–more than once. There are employees who handle enrollment eligibility as part of their job description.

Have you compared our school district to the rest of St. Louis County? One of the top early childhood programs in the state, in an award winning school district? Ours is an area that people move into, not away from. Our housing market (mentioned on this site earlier this month) is booming, and I believe that it’s mostly due to the MRH school district. Our taxes may be higher, but so are our home and resale values. i’ll gladly vote for this.

Agreed, this is a nominal investment to support the outstanding education provided in our school district and the steady increase in resell values of homes. This has my vote!

Higher home values are only good if you are selling not lifelong residents. The only people the over inflated property values help are the sellers, realtor, and the city and county government they all love the inflated property values.

You are right in some respects, but what about the other benefits that come with higher home values? Less crime, better amenities, better infrastructure, etc. How long have you lived in Maplewood? Are you honestly saying that the community is not stronger and the city not a nicer place to live now than it was 15 years ago before the school district turned around? If so, I would be curious to know your reasons for thinking that.

I have lived in Maplewood for more than 3/4’s of my life and my family roots go back to the 30’s. Higher home values do not translate into lower crime rate. I love Maplewood and have seen it through it’s ups and downs but to keep putting more and more monies on my tax bill due to over inflated home prices is enough. Answer this, Do we really need to be paying a person with a Doctorate to teach music at the Elementary school? Over crowding right now is an issue at the schools but preschool is voluntary and something that is not needed. Now you want to build a school that is for K-12 grade then let’s talk. It seems to me that maybe they should look into the old West Richmond building that the district sold years ago they could redo it for use. Yes housing prices in Maplewood are way over inflated in my opinion.

Mike, if you are interested in saving money, then your proposals don’t make sense. it would cost far more to build a K-12 building or rehab an old one to meet today’s educational needs. The purpose of the new preschool is to ultimately free up room in the elementary school. Building the new facility is cheaper and more forward thinking than expanding at the land-locked elementary. The added bonus of a larger preschool is that it will generate more revenue by increasing the number of kids it can accept. It’s the cheapest solution to over crowding and also the one that will bring in tuition. To me, that’s a win-win.

You bring up some interesting thoughts, Mike. I would also like clarification from the district why they are not pursuing renovation of the property you mentioned. Is it too expensive? Concrete numbers would help give us an idea of why they chose this particular plan. It seems to me that this larger building could solve any future congestion problems as well. I wonder what the square footage of the former A.B. Green building is as compared to the plan for the preschool. Perhaps it was twice as much money to purchase, renovate and staff this preexisting school?

The district did consider the former A.B. Green building, but the cost would have been far greater than what prop K is asking for. From what I have been told, the proposed plan was carefully formed and alternatives were explored. We are so fortunate to have such excellent leadership in our district, they are thoughtful and dedicated to doing the right thing for our children and our community. I did ask if there would be opportunities for town hall style Q&A sessions between the district and the community and it sounds like that will be in the plan for the months leading up to the vote.

In my personal experience with our administrators I’ve found they have been very transparent and welcoming to the tough questions.

Thanks for the info, Laine. That’s a shame that A.B. Green wasn’t chosen. Out of curiosity, I drove by it yesterday, and what a lovely old brick building. I am likely in the minority in this opinion, but I would have preferred a larger bond (even double) that would have reclaimed A.B. Green and provided enough space for the district for years to come, i.e. no worries that another bond would be on the ballot in the future. It was, after all, built by the school district and a part of our collective history. I find it hard to believe that 10-12 million wouldn’t have been enough to purchase and renovate that particular building, but then again I am no expert on these things. I just value old architecture and historical continuity.

Anyone else in Maplewood getting a bit tired of having the highest taxes (due to schools) in all of St. Louis County? Last time we refi’d our home, the lender about fell over when he saw our tax rate. Threw his entire original estimate off the tracks. I know $1 to $6 a month doesnt sound like much, but added onto what we already pay..ugg

A quick review of property tax rates for the County looks like we’re in a no win situation. School districts with already high property values have the lowest tax rates (and also the best schools). School districts with lower property values have the highest tax rates to make up the difference in funding.

We have a good district, growing in size and reputation. However our property values can’t match the Ladue, Kirkwoods, of the world. So how can we continue to prosper and improve, without adding to the tax rate? I think we’re in a situation where we need to fund now, to be able to pull back later.

A district with a similar tax rate but arguably better schools is Webster Groves. That district is large though, and encompasses a lot of different property sizes and values. They offer good schools and the residents pay for it. We should keep that in mind.

When have you ever seen tax rates pulled back?

Per city-data.com. Median household income/median house value of the following towns (not school districts)

Maplewood: $31,628/$139,976 <<<<<

Richmond Heights: $59,058/$243,248

Webster Groves: $78,370/$237,372

Kirkwood: $70,232/$226,968

Clayton: $85,142/$592,466

That website is pretty great. But I could use some help clarifying so I can have an idea how long this bond will take to be paid off (and ultimately calculate the final cost to the avg residence). According to the site (see links below), there are 5,280 homes (pop 8,000) in MW and 4,900 homes (pop 8,560) in RH. But I suspect the site is counting each individual apartment in those numbers and those renters would not be paying on this tax, only the building owner would. Any idea into how many homes and apartment buildings would actually be paying the tax?

Doing the math using 5,280 MW homes and 4,900 RH homes paying toward this bond works out to being about $530,000 paid on the bond yearly. It would take 12 years to pay off the $6.5MM school. So in the end, after 12 years of $40 payments, the average MW residence would be paying about $480 for the school. In reality, with the correct housing numbers, it will take closer to 15-20 years to pay off and from $600-$800 per residence.

http://www.city-data.com/housing/houses-Maplewood-Missouri.html

http://www.city-data.com/housing/houses-Richmond-Heights-Missouri.html

Per https://revenue.stlouisco.com/Collection/YourTaxRates.aspx major area districts in St. Louis County

Ladue: 3.7000

Parkway: 4.0743

Clayton: 4.1027

Kirkwood: 4.2524

Lindbergh: 4.2906

Brentwood: 4.6495

Rockwood: 4.7240

U City: 5.1775

Affton: 5.3680

Ferg/Flor: 5.5400

MRH: 5.5500

Webster Groves: 5.8584

Valley Park: 5.5910

Hazelwood: 6.2204

Normandy: 6.2686

Not sure why your lender fell over Babs.

Comments are closed.