Maplewood voters will decide on April 3 — voting on Proposition T — if residents will pay a tax to cover a city budget shortfall for trash and recycling pickup.

The ballot wording, per vote411.org, the League of Women Voters voter information site:

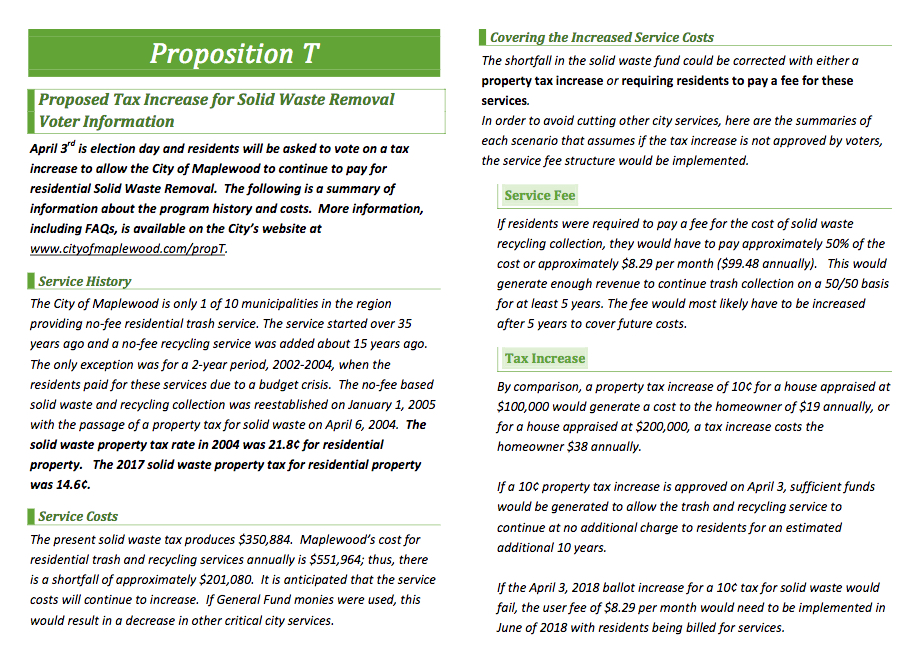

Ballot wording: Shall the City of Maplewood increase by 10 cents per $100 of assessed valuation of all residential property, commercial property and personal property in the City the levy of the existing Solid Waste Tax to be deposited into a fund to provide trash collection and recycling services for single family, duplexes, triplexes and four family residential properties within the City of Maplewood?

Summary: The proposition would hike the property tax rate by 10 cents per $100 assessed valuation to cover increased costs of trash collection. The owner of a home worth $100,000 would pay $19 more in taxes a year.

On the city website, a question the city says many have asked about the proposition is:

How a $.10 per $100 assessed value for a $200k house comes to a cost of $38 annually? Why isn’t it $200 annually?

The answer is:

The formula is somewhat confusing because Appraised Valuation and Assessed Valuation of a property are not the same. Under Missouri State Law, residential property is assessed at 19% of appraised value. Therefore a home appraised at $200,000 has an assessed value of $38,000 ($200,000 X .19 = $38,000). Tax rates are expressed in Dollars or Cents per $100 so you would then divide the Assessed Value of $38,000/$100 = $380. Last you would multiply this figure by the Tax Rate to get your final amount due; $380 X .10 = $38.00 due annually for a home appraised at $200,000.We are available to answer questions.

If you would like to send a question or a comment, please use our Contact Form. City of Maplewood staff will reply to your questions.If you wish to contact the Mayor or Council, please use the Contact the Mayor and City Council Form.

Below is a screenshot from a PDF of the mailer the city sent to residents with more information.

See also: Waste pickup tax increase to be on ballot; residents will pay cost one way or another

Doug Miner, can you see if the Mayor or a member of the city council will comment on 40 South about why the tax rate went down and why they didn’t just raise it back to the level that was approved in 2004? I got an immediate response from the city official and council member that I contacted. There response to me made sense but I don’t want to misquote them.

I meant their not there!

These differing ’04/’17 applied tax rates need to be confirmed and explained by the City. No, the math for Prop T just doesn’t seem to add-up. If Prop T passes, the claimed $201,080 public works deficit should be much less factoring commercial property into this calculus. The mayor has the responsibility, the obligation really to inform Maplewood residents so they can make and INFORMED decision about Prop T. At least address the promise of free trash pick-up in exchange for allowing the Walmart to be built! Were we duped? In addition, the coming 250 higher-income Sunnen Station apartments ($900-$2,200/mo) only exasperates the pressure on landlords already facing ever-rising taxes, fees, utilities, insurance, etc. The current rental market is unsustainable, period. A lot of tenants have nowhere to go unless they want to risk moving into crime-ridden areas many have already fled. Mayor Greenberg, please tell us the TRUTH!

Yes this! We vote today and the silence from the council and mayor speak volumes. I don’t want to have to CALL them for an explanation when I’m sure these posts have been read by at least a few on the council. If this is all on the up and up, why not address these questions here? I agree with Bourne about our representatives having an obligation to ensure the voters in our community are making informed decisions before casting our vote. This is a good forum to reach many people and answer some questions for those of us who are still a bit confused about this.

Michelle, You can say that again! I sent Mayor Greenberg a message but got no reply. Granted during Passover week, but for no one to answer on his behalf is pathetic when it left the voters confused. Prop T predictably sailed through despite these questions about the math behind it and “promise” of free trash in exchange for approving the Walmart. Basically, the City forced it to pass saying the annual fee would’ve been higher. Same as the School District and its tax increases every 2-3 years, a slam dunk every time with more young families now living here. One final remark, a candidate for City Council told me no one from City Hall reads 40 South…that’s great. Progressive leadership?

Why has the tax rate that was collected in 2004, of 0.218 / $100 of assessed value, steadily dropped to 0.146 / $100 of assessed value? Why aren’t they still collecting the .0218?

Mike,

This is really the big question isn’t it! I have no idea how or why this rate hasn’t been raised to keep the fund healthy but I have a few guesses that include fun phrases like: miss management by our city executives, poor government over-site of the fund, or maybe wanting to get other tax rate proposals passed by keep the total city rate artificially lower than it should be? Your guess is really as good as mine at this point but the longer our city officials read this thread and don’t respond the worse they all look IMHO.

I contacted a couple of city officials and got a good explanation on this but I don’t want to explain something wrong or misquote them. So I think it would be best to hear from one of them on this issue. I now know that if it passes commercial properties and apartment buildings will also pay the additional amount as well as homeowners. If it doesn’t pass it will cost homeowners more per year because it won’t be spread out among all taxable properties. The new tax rate for homeowners would be 0.246 / $100 of assessed value. That is only .03 more than the original .0218 that we originally passed in 2004.

Why wouldn’t the cost be spread out among all taxable properties if not passed? Why would it only apply to homeowners? I still don’t get it. ugh

Business and Apartments pay for their own trash removal but also help supplement residential trash pickup through our current tax. If we don’t pass the tax and the level remains the same, then the residents get stuck with paying for all of the difference in what the cost for trash removal is. If it passes then the new tax rate will apply to all taxable properties, including the ones that have to pay for their own trash removal, and it will help supplement the residential trash removal.

Thank you Mike

So if the Prop T tax is an ‘increase by 10 cents per $100 of assessed valuation’ wouldn’t another way to say that is simply multiply assessed valuation by .001? Our assessed valuation is $33,000 per the county, so our tax would be $33 per year, which is lots less than the close to $100 we’d be billed. Am I wrong?

That 33 dollars per year would be the increase upon passage of Prop T.

The document that the city put out listed the 2017 tax rate as 14.6 cents per $100 of assessed value.

So in your situation you’d have

0.00146*33,000 = 48.13

plus the 10 cent increase

0.001*33,000 = 33.00

Total property tax for trash service would be 81.18/year, assuming that the base rate is the same in 2018.

The document from the city says that the rate has changed over time, which I am unclear about how that happens/who decides that/what the rate would be without the Prop T increase in 2018. Anyone have input to that point?

https://mo-maplewood2.civicplus.com/DocumentCenter/View/1755

That is also in addition to what we are already paying in tax for trash collection, but yes, an additional $33/year. I am not sure why if it doesn’t pass we would be paying almost a $100/year. Something doesn’t seem correct with that.

Also Doug, since the 2004 tax rate that we passed was 0.218 / $100 of assessed value is the new rate going to be 0.318 / $100 of assessed value? Or will the new rate be 0.246 / $100 of assessed value, which is 0.10 more than the current level that is being collected of 0.146 / $100 of assessed value?

Yeah Doug, sorry you are partially wrong. The assessed valuation of $33,000 is for non-residential or agricultural property. Residential property is billed at $19,000 per $100,000 by the county, as stated above in the article. But yes you can divide either the tax rate or assessed valuation by 100 and get the correct tax amount.

The formula for anyone wondering about how much they will pay to the Solid Waste Fund is follows: ((House_Value * 0.19)/100) * (2004_Rate + Prop_T_Rate) = Solid_Waste_Fund_Tax

House_Value = the value the county assessor has given your home in appraised value. This number can be found here for any home in the county: https://revenue.stlouisco.com/IAS/

2004_Rate = 0.146 to 0.218??? The actual rate levied is a bit of a mystery as the City hasn’t publicly stated how it determines this rate. In 2004 voters agreed to a rate of $0.218 per $100 assessed value. This rate was too high (probably due to rising home valuations) and the fund swelled with the excess placed in an interest bearing money market. Since then the rate has been lowered and any shortfalls have been paid by the excess. In 2017 this rate was just $0.146 instead of the $0.218, the excess gone and shortfall paid I believe by general City funds.

Prop_T_Rate = 0.10 ($0.10 per $100 assessed property value).

EXAMPLES:

A $170,000 home in 2017 should have been levied ((170000*0.19)/100)*(0.146)= $47.16.

A $170,000 home in 2019 if Prop_T passes and the 2004_rate is the same as 2017 would pay ((170000*0.19)/100)*(0.146+0.1)= $79.46.

A $170,000 home in 2019 if Prop_T passes and the full 2004_rate is applied would pay ((170000*0.19)/100)*(0.218+0.1)= $102.71.

A $170,000 home in 2019 if Prop_T fails and the 2017 rate is applied would pay ((170000*0.19)/100)*(0.146)= $47.16 plus $99.48 annual fee = $146.64. [Quick note here; in the Prop T mailer the city states if Prop T fails the tax rate and fee will be making a 50/50 contribution to the fund for the next 5 years.]

Yes, someone from the city care to jump in and answer these questions before we vote? What about the Walmart? What about the numbers not adding up? How come we will be charged MORE if this does not pass? There are discrepancies that really need to be answered before voting day.

Hah, I just did the math myself using median home values and was coming to 40 South to comment. Someone check my math. I realize using median home values might not give an accurate picture of the situation, but I think its the most reasonable estimate we can come up with.

Median home value ($163,300) / 100 * .19 (19%) * 0.10 * 4,269 homes (from cityofmaplewood.com) = $132,210.93

Shortfall in the mailer on Prop T is $201,080. That leaves $68,869.07 to make up. I suppose that would be covered by commercial property? Commercial is included, according to the sample ballot I just got. Just guessing, but I bet its over 68k when you add in commercial.

At any rate, things don’t add up completely. Would be nice to get a straight answer on this. I won’t be voting for it unless we do.

Rob, Your math looks correct to me but we don’t really have the details to how much the commercial side would put toward the shortfall. Commercial properties are taxed at both a higher rate, 0.241 (commercial) vs .0218 (residential), and commercial properties have higher assessed values, 33.33% vs 19%, of appraised amount. Although your number of residential properties seems a bit high to me, in the 2016-17 budget only 2629 households were charged for trash pickup and 1560 households for recycling pickup.

Commercial tax is also probably why there is such a large discrepancy between the amount residence pay between if Prop T fails or passes (see my examples above). If Prop T fails residences will have to pay for the entire shortfall via the annual fee ($99) versus if it passes then commercial property tax helps fill in the gap via the tax rate bump.

I’m still wondering what happened to the City telling it’s residents, that if we agreed to have WalMart come to Maplewood, the residents would not have to pay for trash pickup. WalMart is still here, and now they’re saying we need to pay for trash pickup?

That is a good question. If I recall, this issue came up when Mark Langston was mayor. It was one of the main issues when we voted on the Walmart construction. So now it is no longer valid??

The last time this issue came up “trash sucks” asked a question and i never saw an answer. Quoting from them: “Nut shell: At today’s median Maplewood appraised value of $162,000 trash pickup currently costs $67.10. The new measure would add a new $30.78 to the current $67.10 if it passes for a total of $97.88 for a home appraised at $162,000.

If it does not pass, the median appraisal pays $67.10 in tax and are billed an additional $97.92 annually, totaling $162.02???”

Link to full comment: https://40southnews.com/assistant-city-manager-explains-how-new-tax-would-be-cheapest-option/#comment-62306

So, what is the answer here? Is the Total Cost the same for a house with a $162,000 appraised value or are we going to be arbitrarily charge more if the tax does not pass? Every time i see this it sounds like the numbers coming from the City are intentionally misleading.