Maplewood now provides trash and recycling pickup for residents for free, but that might change. The city council is set to consider options to have residents help cover the cost.

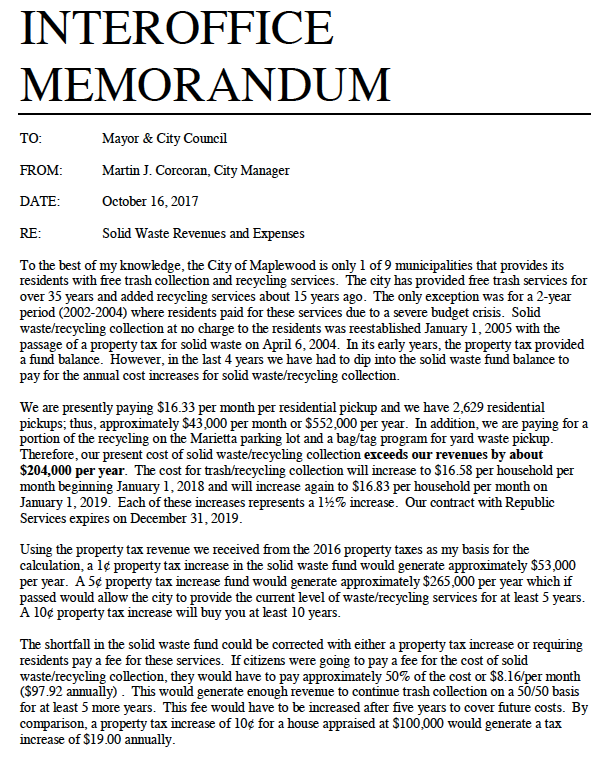

Maplewood City Manager Marty Corcoran sent a memo to the mayor and city council in October outlining some options.

The cost to the city for the service is approximately $43,000 per month or $552,000 per year, according to a memo from the city manager to the council in October.

The pickup costs are expected to increase this January and January 2019, each one an increase of one and a half percent. The city’s contract with the pickup service expires at the end of 2019.

The city manager presented several options, including property tax increases of 1 cent, 5 cents and 10 cents; or requiring residents to pay a fee of $8.15 per month, which would be approximately 50 percent of the cost.

Maplewood City Council could vote soon to put a property tax increase on the April 3 ballot.

While I like Maplewood a lot and have lived here for 30 years I am concerned about the property taxes. I am currently at a little over $200 a month in property taxes for my little 1000 sq ft home. Especially if you look at the taxes for a similar size home on the other side of McCausland in the city of St Louis. It would be half or less. Makes me wonder if the exodus from places like Maplewood and Brentwood will cause people to return to the city because of these types of costs. For the record I say no more breaks to the companies that want to come into our town, no tax free agreements for the first 10 years they are here.

I have to wonder how some of our older folks in town that retired years back and thought that they were going to be doing so well in retirement with what they were going to be getting are making it. That amount takes a big chunk out of any retirement or Social Security check they are getting. I am now considering that very fact as I get closer to retirement but love my home.

The original agreement was, if Maplewood residents agreed to have WalMart, we would get free trash pickup. We still have WalMart, we should still get free trash pickup.

Not only has Walmart been added but Deer Creek shopping has reemerged. Our property taxes have increased 125% during the time that we have lived in Maplewood. The city already charges us for yard waste when across the street from from my house in RH it is free. It seems like there is a lot more money coming into the city during the past 20 years, but the services we are receiving don’t seem to be increasing.

What the heck? Suddenly they can’t afford it anymore after 35 years and are considering charging us? Something smells.

I agree with Patty, let’s see those statements.

Gee wiz all the revenue Mapelwood brings in with chicken fast food should cover trash haul away.

Where can I access the financial statements of the city of Maplewood? I’d like to see the monies in, and the monies out.

I’m looking at a couple of utility bills right now: approx 10% Maplewood tax on Ameren service, approx 10% Maplewood tax on Spire service. My real property taxes were to be increased 100% this past year. Due to my objection, they were only increased approximately 30%. When is enough enough?

Patty, the 2016-2017 budget can be found here

http://mo-maplewood2.civicplus.com/DocumentCenter/View/949.

For a deeper dive, check out the city’s comprehensive annual financial report: https://drive.google.com/file/d/0B54h43bSg4s0dnVZUjYxTml2Qm8/view

For some context, this memo was written as it related to the council voting to transfer $278,702 from the general fund balance to cover the current solid waste deficit.

My first thought was, is it possible to continue to use the fund balance to cover the deficit to avoid passing the difference on to tax payers? If this solution is fiscally irresponsible, so be it. But, I was at the council meeting in which council members voted for the transfer and there wasn’t any objection. I was also at the last council meeting in which council discussed putting the 10-cent increase on the ballot. There was no discussion of exploring alternative funding options. Again, if none make sense, that’s fine, but at least explore every possible avenue before asking residents to pay more in property taxes.

The city and council members need to provide a very clear explanation about this. The issue is prone to confusion, and multiple residents I’ve spoken to feel like they’re being taxed out of house and home.

Hope the info on financials helps.