The Maplewood Richmond Heights Board of Education placed Proposition Y on the April 5 ballot to “maintain the current level of programs and meet the needs of the growing enrollment,” according to the school district. If the proposition fails, the board has laid out how the district will handle not being able to fill the additional 20 teaching/support staff positions needed to meet the needs of the growing enrollment, and more.

On the MRH website:

The Board of Education has placed Proposition Y on the April 5, 2016, ballot to maintain the current level of programs and meet the needs of the growing enrollment. Prop Y calls for an additional $.55 operating tax levy per $100 of assessed valuation of property. Of this amount, $.45 will be dedicated to general operating expenses and the remaining $.10 will be dedicated to capital maintenance projects. If passed, Prop Y will annually generate approximately $1.1 million for the District’s operating budget and $240,000 to capital projects.

In the event Prop Y does not pass, the District will not be able to fill the additional 20 teaching/support staff positions needed to meet the needs of the growing enrollment. This will result in a significant increase in class sizes, impacting student achievement and the personalized public education for which MRH is known.

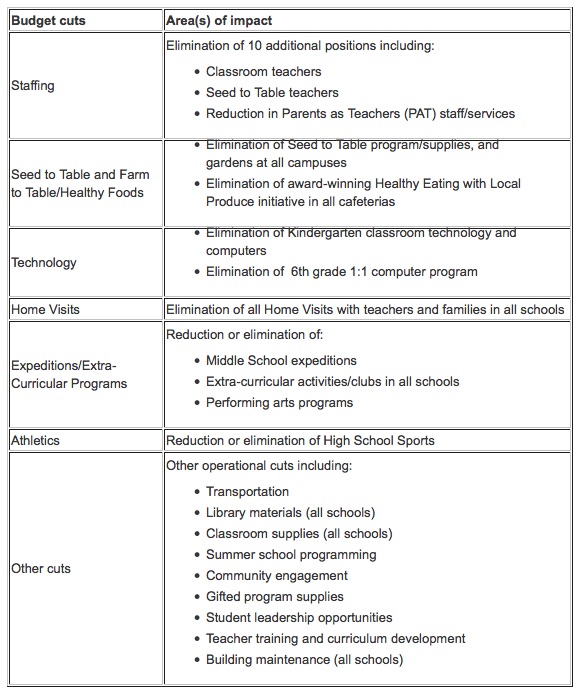

The District will also be forced to make additional cuts to maintain the fiscal health of the district. Working closely with the administration and staff, the Board has identified these additional cuts totaling nearly $1,000,000 to be implemented beginning in the 2016-17 school year.

See the full post by the MRH School District.

I will vote no….again. Wasn’t this same proposal just defeated last year? How many years in a row will it be put on the ballot for a vote? I guess until it passes?

I have owned my home in Maplewood for 25 years. It is a very small 800 sq foot home and my taxes are already over $2000.00 a year! Another increase like this can cripple some homeowners here who are already struggling. We are not in Ladue or Clayton here! The schools are fine and even recognized for achievements. We need to see “exactly” what the current funds are being used for and how to better utilize those before ANY new taxes are asked for. Something is not right.

Another problem that I, and many others who are homeowners in Maplewood have is the fact that only a little over 40% of people in Maplewood are actual homeowners. People renting homes and apartments have no “skin in the game”, so why wouldn’t they vote yes? Renters can come and go from a community at almost anytime and leave the homeowner with the burden. This just does not seem right. The house next door to me is rented. I’ve been through 2 neighbors in 2 years. Last year, when this same proposal was on the ballot, the renter next door had a “yes” sign in her yard and voted yes on the proposal. It failed. She was a school teacher in another district. She is gone now and new renters have moved in with a small child who also plan to only stay a year. So a large part of why these proposals end up passing eventually is usually not due to the homeowners who pay for this. It is due to the renters who vote for it and then move on. And the council, who continually put it on the ballot and find recruiters to target people for votes. I read a website where they are urging college students who are away at college, but have an address here to vote absentee. Again, most likely no skin the game from the college kids either. Ugh…frustrating.

Mick, to answer your question, Proposition K for a new MRH kindergarten was voted on last year, and it passed.

My mistake then, and thanks for the correction Doug. But that doesn’t change or address anything else in my comments regarding homeowners and tax burdens. Or homeowners vs renters. Actually it validates my point even more about taxing burdens on people. Schools got what they wanted last year, so let’s try again this year to get more? I’m not the only one who feels this is somehow very unfair. Even with the “supposed” home value increases…. which by the way, doesn’t always happen. My house is worth way less now than it was in 2007, even after all the school improvements. How is that appreciation? And yes, I keep my house up very nicely.

Mick, last year’s vote was for a bond issue and it passed overwhelmingly. That bond issue will pay for additional brick-and-mortar facilities to make room for the growing student population. The current proposition is for a tax levy to increase operational spending (paying for teachers, mostly). This is also largely driven by increases in the student population.

It is true that school district tax rates do tend to run higher in the mid-county area for several different reasons, and municipalities like Maplewood with lower property values generally have the highest rates. However, MRH’s per-student expenditures are lower than many of our neighbors and faculty salaries are in the middle of the pack. The main driver behind the increases is growth in student population, and that is because the improvements to the district are attracting more young families to the area. More info here: http://www.mrhschools.net/news/proposition-y/faq#Finances

Renters may not pay property taxes directly, but I would expect the costs to be passed on to them in the form of higher rent. I get your concern about skin in the game, but last I checked, we don’t require people to be land owners in order to have the right to vote.

I’ve already been corrected on last year’s vote by Doug. But thanks. Still doesn’t change the burden to homeowners.

The fact that people can vote on an issue in a community that only targets specific people to pay for it is a whole other can of worms. I’m not saying people do not have a right to vote. But….I’ve always believed it to be unfair that people in a community who “do not have a burden” attached to an issue that requires revenue from the people in that community to be able to vote to pass it and just move on. Just my 2 cents. Nothing I can do about that…except vote no. Which many of us will do for this reason. Higher rent is not an issue for a renter with a lease until possibly the following year. People who rent, instead of buy tend to come and go quickly. I’ve been seeing it right next door for the last couple of years…and many other places near my street.

I understand that younger families are moving in and have school age children. Which is good, I guess. But what is the percentage of buy vs rent for these new families? And yes…it matters.

Mick, you are correct in that it seems about every other year MRH comes back to the taxpayer asking for more money. One time it’s to renovate the aged high school, another time to expand the pre-k center, this time to give the teachers a raise. Believe me, if this passes or not, they will be back for more. The school board likes to claim that the expenditure per pupil is lower than what they actually spend. Yes, according to the accounting rules and the operating revenue that they are allowed to report, their cost per student is in the $14k range, still high if you ask me. However, when you count the total revenue of $28 million dollars (WOW!) the cost per student is more like $22k. It’s ironic how they don’t count all the revenue and operating costs! Perhaps when I apply for financial aid for my kids college this year I’ll report only half of my income. Then when they question or the IRS audits me, I’ll say that I didn’t report the other half of my income because that is set aside to maintain the building I live in, and for the man-cave I plan to add in my backyard!

NO MORE TAXES!

Repeal the Blaine amendment so that real school choice can be an option for all parents not just the wealthy, have a real school choice option.

http://www.cardinalnewmansociety.org/CatholicEducationDaily/DetailsPage/tabid/102/ArticleID/4634/SCOTUS-Agrees-to-Hear-Missouri-Blaine-Amendment-Case.aspx

VOTE NO ON PROP Y

The Maplewood Richmond Heights School District is pushing yet another tax increase. This time it is called “Proposition Y” on the April 5th ballot.

This proposition will increase taxes 55 cents for every $100 of assessed valuation. For my family that’s approximately an additional $255 every year. That is in addition to the previous school bond and tax issues over the last several years, effectively doubling our tax burden!

The MRH School district’s 2016 budget lists total revenue of nearly 28 million dollars, educating 1,230 K-12 students. That comes to a total spend per student of $22,644.

If this fact alone doesn’t make clear that the government education cartel is out of control then nothing will. Stop crippling taxpayers, especially seniors, with ever increasing tax burdens; end the school district fiefdoms and consolidate districts; better yet, change the Missouri constitution to allow for school vouchers so that parents can have real choice in education. I am certain that most parents would love to be able to send their children to any school, including the best private schools, for less than the cost MRH is spending per student.

VOTE NO ON PROP Y (and every other tax increase)!

As someone who works with schools and has seen draconian funding cuts in districts throughout the metro area, I will likely vote for this, but it is realistic for us to ask where this is heading. This is the third major property tax increase in recent memory. Mayor White used to brag how he lowered taxes. And now we are reversing course. At some point, property owners in MRH are going to feel tapped out. With Maplewood in it’s current renaissance period, this might a good time to ask for a long-term financial analysis from City Hall. Should we examine other revenue streams, such as a special entertainment district sales tax or something that hits up our giant retailers like Wal-Mart? Part of Maplewood’s allure is not just the schools and hip scene. People are drawn here because the cost of living is more affordable than in any of the other inner ring suburbs. The ECC principal has worked hard to earn her salary, but it is still considerably higher than what most families earn in Maplewood.

I followed everything you said, but your last comment doesn’t make sense. If school districts determined the salaries of their employees based on the average income of its citizens, there would be districts without employees. The principal of the ECC makes much more than I do, and I can tell you that she also works much harder, longer hours than I do. Her vision many years ago helped create the school that so many seek today, and many would argue that she helped build it with with her own sweat and effort. Her salary is based on years of experience and education level. It’s a dispassionate formula. To pay a lower salary, we’d have to replace her with a less experienced and/or less educated employee. I want the MOST qualified person in shepherding us through these changes in our district.

It was a tangential comment meant to address the complaint of a previous commenter that our school staff is overpaid, while acknowledging their point of view (i.e., I get where they’re coming from, but our staff deserves to paid well). It was perhaps an inelegant way to close my argument.

I was also trying to point out that few families paying these taxes make six-figure salaries. Maplewood is mostly a middle- and working-class city, and homeowners could be in danger of being priced out if taxes get too high. It was not meant as an indictment of the principal’s salary.

School district funding has nothing to do with municipal funding. They are totally separate. Whatever the City of Maplewood is doing regarding sales tax, etc. has nothing whatever to do with MRH Schools funding.

Yes, but why? Why can the school district collect revenue only through property taxes? It’s not unheard of to finance schools with sales taxes or other fees.

I moved to Maplewood 14 years ago. I have seen the school district excel thanks to parents that were pioneers, dedicated teachers and and administration that continued moving forward. This district is proof that all children from diverse economic and cultural backgrounds can excel in academics and in life. investing in the schools means an investment in the community. I hope everyone gets out to vote for prop y to help continue moving the school district in the right direction.

Maybe if the MRH school district is so concerned with the children in their care, they should start by reducing the superintendent’s salary?

The principal at the ecc makes almost $150000. Take a pay cut and keep seed to table.

The principal at the ECC makes $125k, I wouldn’t call that ‘almost 150k.’

@Jan – Here is a bit from the FAQ provided by the district comparing salaries. The Superintendent salary ranks 23 out of 33 local districts.

Q: How do the salaries of MRH staff compare to other St. Louis area school districts?

A: Salaries and benefits typically account for approximately 80% of MRH’s operating budget. MRH teachers typically fall in the median while administrators fall in the lower half when compared to other St. Louis area districts. Here are some examples from St. Louis area comparability data:

Teacher (Baccalaureate degree/Step 1): MRH ranks 13/33

Teacher (Masters degree/Step 1): MRH ranks 14/33

Teacher (Doctoral degree/Step 1): MRH ranks 17/33

Assistant Superintendent: MRH ranks 21/33

Superintendent: MRH ranks 23/33

I have an 850 sq. ft. 2 bedroom brick home in Maplewood that needs remodeling. My taxes are over $2,800! That is ridiculous. I own other properties in other areas, and this is WAY more than anywhere else. Double to triple the amount of the others. I am fighting it now. I don’t have a problem with paying more, but when will it stop? In my area they jacked up the appraisal of our LOTS by over $30,000 in one year. And the value of the improvements was lowered. $400 increase in one year…. What is that about?

$2800 on a 2BR seems high unless it is a really nice place. I paid that last year on a 4BR. Several years ago, when my property (similar size to yours) was appraised at a ridiculous value, I filed an appeal with the assessor. I provided evidence of recent home sales and listings with pictures, and they revised the appraisal downward. Good luck!

I think it is a steep increase but I am voting for Prop Y. It’s an amazing school district and the fact that we have grown so big so fast just tells the community that families want to move to Maplewood/Richmond Heights because of the awesome school district.

Doesn’t the higher demand, as discussed in these comments, drive up property values and, consequently, the school district tax money all by itself? I don’t know how many more homes are being built. Perhaps this isnt quite fair since I’m guessing there are more new school students than newly added total mrh bedrooms being created each year if the district is bringing new youth.

My children are grown but, I am in total support of Prop Y… a quality education for all is at the top of my priority list! AND I’m loving the increase of my property!!

The taxes seem to go up every year and I struggle to pay them. My wife says Maplewood’s taxes are higher than other communities, such as Brentwood. Why is that?

While there are many reasons for this, chief among them would be property values. Brentwood’s property values have risen to such heights that tax rates can remain the same. The homes in the MRH district, while rising more quickly than much of the metro area over the last 5-10 years, are still much less valuable.

Ouch. I don’t live in the immediate area, but my son does go to St. Mary Magdalen. Communities need strong schools and programs BOTH public and private to stay strong and to grow. Seeing this many cuts would kill the school which would affect the whole community as a whole. I sincerely hope Prop Y passes!

Does anyone know if there are yard signs or other ‘campaign’ material that we could utilize to demonstrate our support of Prop Y?

Keep MRH Strong is a local campaign in support of Proposition Y. You can get more information, request a yard sign, sign up to volunteer or make a donation at http://www.keepmrhstrong.org/. Yard signs will be delivered on March 6.

I am curious about the same thing.

We bought our home in Maplewood at the absolute height of the housing bubble. When the bubble burst, I was worried that we’d lose a tremendous amount of value. Instead – we’ve continued to gain value on our home.

I absolutely give all of the credit to the school district. All of it. I have no problem paying more in taxes to support the district and its endeavors – it’s not just educating my children, but it’s keeping up the value of my home and my neighbors homes.

Katie,

I could write the exact same thing, and I know plenty of others with the same circumstance.