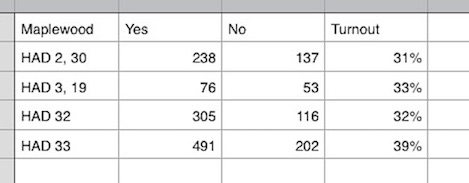

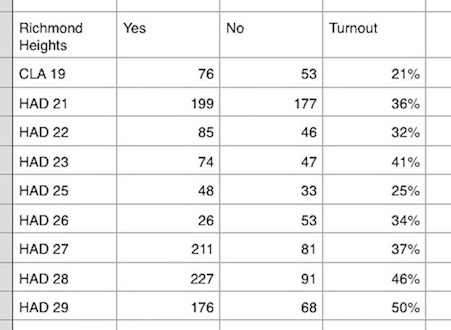

The MRH Proposition Y passed in every voting precinct in Maplewood and Richmond Heights but one in the April 5 municipal elections. The results are now certified and posted on the St. Louis County website.

The proposition had its biggest Maplewood support in precinct Hadley 32, with 72 percent voting for Prop Y. Hadley 33 had 71 percent in favor; it also had the largest turnout in Maplewood, with 39 percent.

In Richmond Heights, precincts Hadley 27 and 28 voted 72 percent in favor; Hadley 28 had 71 percent in favor. Hadley 29 had the largest turnout with 50 percent of registered voters. Hadley 26 was the only precinct to go against Prop Y — by 67 percent.

Richmond Heights also voted for council members and a mayor.

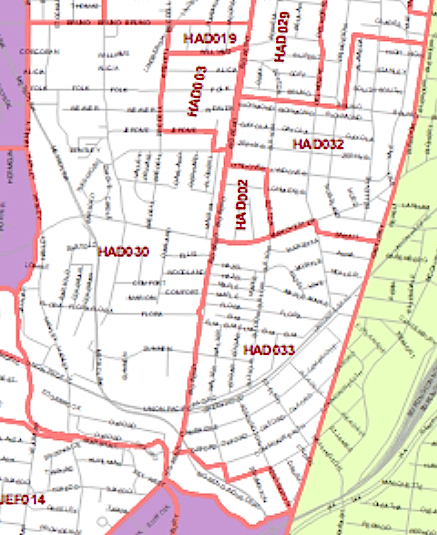

The Maplewood voting precincts:

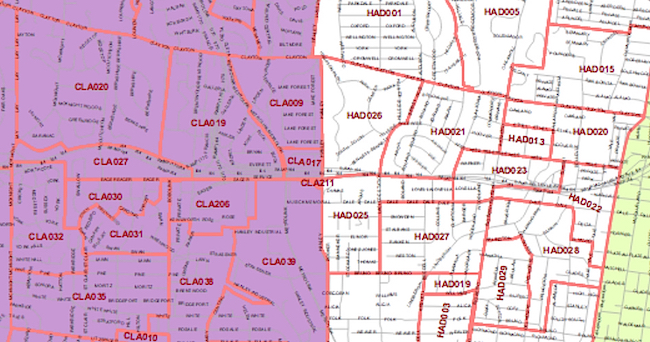

The Richmond Heights voting precincts:

I’ll tell you what’s sad…… uh, wait, no…… I’ll tell you what’s not sad…… anecdotal I know, coincidence perhaps, but has anyone else noticed since Prop Y passed there have been more houses in Maplewood sell or go under contract for $300k+ than at any other comparable period of time? If there is a correlation, every property owner in Maplewood has had their net worth increase since Prop Y passed. That does not make me sad….. quite the contrary. Good schools matter.

Coincidence.

I’d be willing to put 100.00 into a fund to help pay taxes for someone who needed it

I’d be willing to put 100.00 into a fund to help others pay their taxes.

The problem with billionaires feeding at the corporate welfare trough is that eventually you run out of other people’s money to spend.

Now that is sad!

Do we really have to go over this again? OK, once more for those who can’t quite seem to understand that the hard-working, successful do indeed pay more than their fair share and support the millions who pay nothing! Further, these same “rich” contribute enormously to charitable causes. Keep biting the hands that feed you and see what happens.

From Pew Research:

In 2014, people with adjusted gross income, or AGI, above $250,000 paid just over half (51.6%) of all individual income taxes, though they accounted for only 2.7% of all returns filed, according to our analysis of preliminary IRS data. Their average tax rate (total taxes paid divided by cumulative AGI) was 25.7%. By contrast, people with incomes of less than $50,000 accounted for 62.3% of all individual returns filed, but they paid just 5.7% of total taxes. Their average tax rate was 4.3%.

Still, that analysis confirms that, after all federal taxes are factored in, the U.S. tax system as a whole is progressive. The top 0.1% of families pay the equivalent of 39.2% and the bottom 20% have negative tax rates (that is, they get more money back from the government in the form of refundable tax credits than they pay in taxes).

** SMH, raised eyes, the whole nine yards **

Yes, we really DO have to go through this all over again.

$59 billion for “traditional” welfare. $92 billion for corporate welfare. And that’s not even counting the $1+ trillion dollar wars in the Middle East, which, let’s face it, were never about WMDs but about making the Military-Industrial-Banking complex wealthier.

http://thinkbynumbers.org/government-spending/corporate-welfare/corporate-vs-social-welfare/

I agree with you that the federal government is out of control and that greedy special interests from all ends of the political spectrum have pushed our economy, our military, our society, and race relations to the brink of disaster. However, can we bring this discussion back to the local level?

Corporate business tax deductions vs social welfare programs have little to do with local taxpayers and MRH funding.

My point about income taxes is relevant in that high(er) income local residents are paying the majority of taxes to support MRH and every other government entity. My comment was in response to the criticisms directed at these taxpayers by those that likely pay little to nothing in taxes, yet want the “payers” to pay even more.

Everyone wants good schools, and most people like the fact that their homes are appreciating in value, that is until their St. Louis County reassessment comes and the find that – “oh my taxes increased again!”.

The argument has been and will continue to be that government and union run schools are inefficient and expensive, and further, the Missouri state finding model based on home values is dysfunctional and clearly “unfair”. The people that are paying the most to support this mess have had enough.

It is time for real school choice and the first step is to amend the Missouri constitution to repeal the Blaine amendment.

Amen to that John Burke!!! Amazing how so many think they are entitled to other people’s money and how many of those same people have the nerve to turn right around and criticize those same people that they live off of!

Your “entitled” remark says a lot about how you view these matters. You are, of course, entitled to your opinion, but it’s the disdain in your tone that’s sad and repulsive. I’d like you to walk up to a less advantaged person, look him or her in the eye and say, “It’s amazing how you think you are entitled to other people’s money”. Please do this, then feel alright with yourself, then go to church on Sunday and tell Jesus about how good of a person you are.

Well, well “calling out all the hypocrites” hope you feel better about yourself after you and apparently Jesus have judged me without even knowing me… I am sure you are aware of all the fraud that goes on with public housing, food stamps, welfare and all other entitlements. If not, please educate yourself as this is what some of your taxes are going towards. If someone is truly “less advantaged” than I then I have no problem in helping them and I do whatever I am capable of towards helping them out of their situation. And I don’t need to go to church to tell Jesus how good of a person as I as he already knows my heart as well as my deeds. Thanks for you concern, though.

Well, well, Marty, I betchya know a thing or two about corruption and greed, and I’m sure you have nothing but love in your heart as well, sure.

Calling out all the hypocrites and Something Good in Our Neighborhood….. Jesus loves you both and so do I! Please don’t hate on me because I use facts and logic, which I am sure boggles both of your little minds…. Have a good day!

What I find is SAD is the fact that only ONE precinct reached the 50% voter participation rate. Now that is SAD!

I’m guessing none of the Hadley 26 residents send their children to our schools, so they don’t feel that they should participate in supporting us. They have the wealth to do it, but I suppose it’s some sort of principle with them. You know: if you live a lifestyle that is cut off from reality and you really don’t want to see things as they truly are, then chances are you probably won’t. Sad.

I’m guessing those people in Hadley 26 pay property taxes in multiples to what you pay. Yes, a lot of them also provide the benefit of not using the resources of the school district – another plus.

Why complain about residents who pay a $10-20k property tax bill every year?

A lot of big houses and pools in Hadley 26, going by Google Earth.

I’d be willing to guess probably a higher concentration of owner occupied dwellings than the other precincts, but I’d love to see the numbers.

Don’t know if it’s more owner occupied, but it’s likely the wealth is higher and they probably do not send their children to our public schools. Sad.

So they are contributing a larger dollar amount and not adding to the expenses by sending children to the school and you think this is sad?

Sounds like the kind of people a school district needs.

Right on Roger!

Hampton Park residents and every other with a home assessed as valuable is paying a virtual fortune in real estate taxes. The only people detached from reality or those who pay little to no tax allowing the “wealthy” to pay the lion’s share and then have the nerve to complain about it.

The problem with socialism is that eventually you run out if other people’s money to spend.

Now that is sad!

No one seems to mention that there are retired/elderly residents on fixed incomes who can’t afford a hike in property taxes – taxes that must be paid or they no longer own the property.

That’s what is sad.

What’s also sad, is a $28 million budget for 1,200 something students.