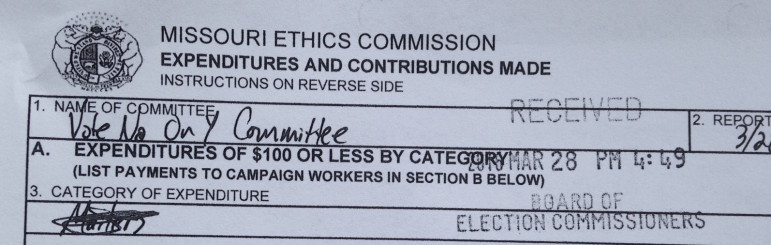

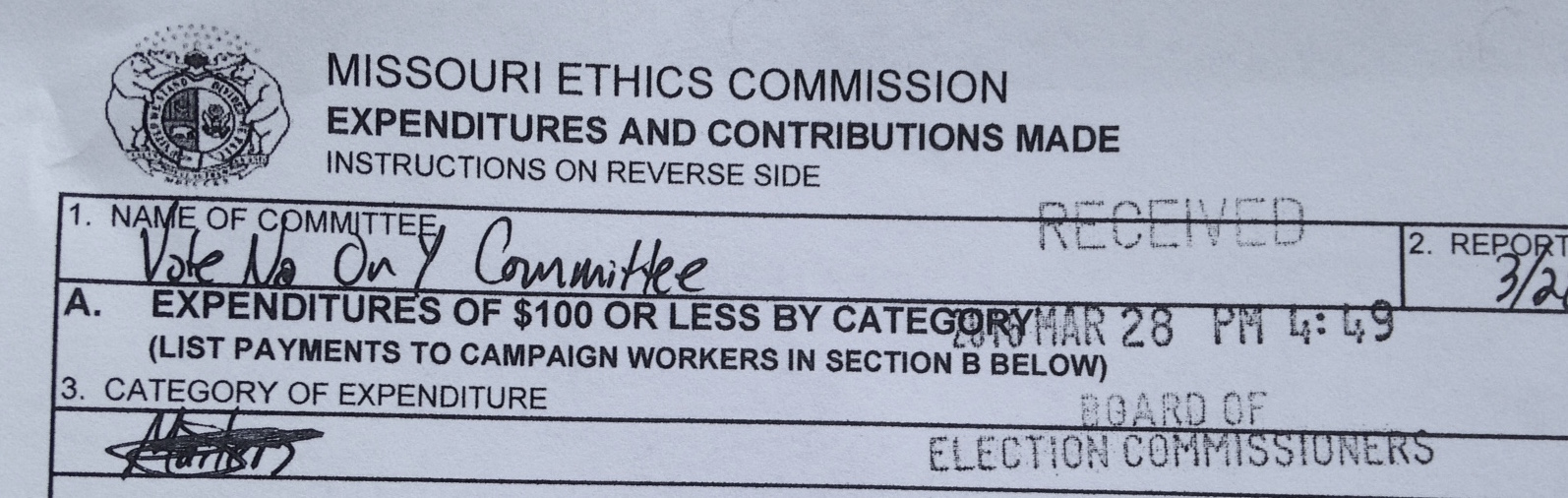

The ‘Vote No On Y’ committee, formed to oppose the Maplewood Richmond Heights School District’s Proposition Y, has filed a required financial report with the Missouri Ethics Commission. The election is April 5 — looks like mailers are in the works.

The ‘Vote No On Y’ committee, with Maplewood Ward 1 Councilman David Cerven as treasurer, has had $818.98 in contributions, according to its 8 Day Before Report. The contributions aren’t itemized because all are under $100.

The total expenses of the committee are $810.85, spent on mailers, bought from Allmail USA, Inc., in St. Louis.

See also, on the MRH Prop Y:

- Council members, MRH board member responds to councilman’s opposition to Prop Y

- Councilman, treasurer of ‘No on Y’ concerned with high property taxes

- MRH School District disputes, corrects ‘No On Y’ postcard statements

- Cerven: Prop Y ballot language “not all of the truth”

- Proposition Y committee: financial report

- City official supports ‘Vote No On Y’

- ‘Vote No On Y’ reports contributions, expenses

- MRH plans $1 million in cuts, if Proposition Y fails

- MRH board, parents discuss Proposition Y in meeting

- MRH board votes to place Proposition Y on ballot

On April 5, I’m voting to Keep MRH Strong!

MRH is a great school district and I am really happy David Cerven is bringing prop Y to property owner’s attention.

I dont care what the correct amount of per student spending is, if my daughter’s private school spends less than $6000 per student, why do the public schools need more when they already get over double what a private school can run on?

Also, I dont care what MRH’s tax base is, our property taxes are high enough. I am about to buy a 3200 sq ft commercial building in Maplewood and the property taxes are over $10,000 a year. Maplewood is developing and the tax base will increase. Let’s not scare away new businesses and further development by raising the exorbitant taxes.

VOTE NO ON Y.

Also vote no on MSDs S and Y. Dont subsidize big parking lots.

Information and clarification on the incorrect information in the recent mailer.

The Facts Regarding Prop Y and MRH

Recent postcard mailed to the community contains incorrect information.

A recent postcard mailed to community members unfortunately contains incorrect information regarding Proposition Y and the Maplewood Richmond Heights School District. To ensure our community has the correct facts, we have compiled the following information:

St. Louis County tax rates are a combination of rates. You cannot look at one segment because the whole tax rate calculation is done on an average of four different types of property: Residential, Commercial, Agriculture, and Personal Property. A proper comparison of MRH with other school districts must be based upon this whole tax rate calculation. When this is done, the passage of Prop Y will put MRH eighth among St. Louis County districts and not at the ranking stated on the post card.

MRH’s expenditures per student fall within the median for mid-county and at $14,253 (2014-15) are well below the neighboring districts of Brentwood ($16,488) and Clayton ($17,870). The figure of $18,934 presented by others is simply incorrect.

MRH’s tax rate is slightly higher than other districts because MRH has the smallest tax base of any mid-county school district, resulting in the need to have slightly higher rates to generate the same revenue. Because of this difference, other districts can tax at a lower rate to get even higher revenues than MRH. This factor is further complicated by the nearly $10,845,900 in property within the District that is subject to TIFs (tax increment financing), for which the District receives little or no tax monies.

Assessed Value of District

Enrollment

(not including Pre-K)

Assessed Value Per Student

Clayton

$1,002,431,060

2,548

$393,419

Brentwood

$299,890,010

788

$380,571

MRH

$263,038,660

1,198

$219,565

* Data provided by DESE for the school 2014-2015 school year.

For complete and factual information on Proposition Y, we encourage all residents to visit http://www.mrhschools.net or contact any member of the Board of Education.

It’s actually helpful that the Vote No crowd sent this flyer. It boils their concerns down to bullet points, each a fact, but without context. I’ll add some.

MRH will have the 3rd highest property tax rate in St. Louis County. True, because our community is smaller with significantly less assessed property value. Districts like Clayton and Ladue can have smaller tax rates and raise greater amounts of money.

MRH will have the second highest spending per student in Mid-County ($18,934 per student). True, I guess. From some experienced comments below, larger districts can spread out their costs. Economies of scale. I believe the highest in Mid-County is Brentwood, another small district with excellent reputation. And why is ‘mid-county’ important for this bullet, but not the first bullet (all the county)?

In the last 6 years the MRH School District tax rate has increased 27%. True, but why limit it to 6 years? When Prop Y was passed in 2010, it was the first increase in 9 (!) years. So another way to state this would be to look at the tax rate over the past 15 years since 2001. What’s that increase?

To add to my points, the data on the scorecard isn’t even 100% factual.

http://www.mrhschools.net/news/latest-headlines/2016/04/01/1053/

Tell me someone is going to run against David Cervan when he is up for reelection next year? Sadly I’m not in ward 1.

Truly disappointing that an elected official chooses to spread misleading negative propaganda. Of course, look at our national election.

Sadly, there is such a small turnout for these elections, the amount of time and effort expended doesn’t always reflect the actual feelings of the community. Typically, city council election turn out is 7 to 10% of the registered voters. As for Cervan, at least he was bold enough to bring to light a lot of what the ‘other side’ is thinking and to let citizens know that they are not alone in standing up to the school district. The vote yes side is trying to make it seem as if the vote no side is not community minded.

My kiddos are thriving at MRH. My house value has seriously gone up in the 14 years we have lived here. My community has gotten way cooler. The staff at MRH is phenomal…the oppurtunities and quality our kids are getting for an education is wonderful. Why wouldn’t I vote for PropY. If Prop Y doesn’t pass dont run too fast newer families to the district. We really need to KEEP MRH STRONG.

So let’s say for a minute the district leaders were able to anticipate the 40% influx of new kids when they put Prop K on the ballot a few years ago…………….

Should they have made the prop K request 40% higher? To avoid the current prop Y proposal? Would any of you voting no have voted for it to avoid this vote?

Absolutely not and nobody else would have voted for it either.

Where do you think our schools would be today without the Prop K of yesterday ?

What caliber of kids would have shown up in your community these past 5 years?

Do you want the kids in your neighborhood to be in school, engaged, getting an education?

Or do you want all those kids to go to private schools or neighboring schools,,,, While the kids left in our neighborhood that walk past our house , that spend time in our stores and hang at our parks,,, become disinterested in the bare bones education we are able to offer them, that include no extra curricular activities….

What do you think happens to uneducated youth? What do you think happens to the neighborhood s they end up staying in but are never able to contribute to because they failed to achieve the basic skills needed to be successful?

Open your eyes. It has happened on our very boarders. It happened with St Louis public school neighborhoods!

We are the tipping point between hugely successful (Clayton) schools and neighborhoods and the opposite (ST Louis Public) schools and neighborhoods!!!

You talk like Prop K was years ago this was just last year. I don’t think there is much difference now then last years when Prop K was passed.

Dear Harold,

Your comment indicates a misunderstanding of the difference between last year’s Prop. K and this year’s Prop. Y. Prop. K was a bond issue to build an addition to and to renovate the Early Childhood Center to provide additional classrooms. This will then allow us to reduce the population at the Elementary School by moving the second grade to ECC. None of those funds can be used for operating expenses. Prop. Y is an operating levy and will now allow the District to hire the additional teachers to put into those classrooms, and to maintain the many existing programs that have created the high quality education that MRH is now known for, both locally and nationally. The two levies by law must be for very distinct purposes, and as such cannot be compared as apples to apples, as your comment suggests.

As a school board member these are obvious differences, but not necessarily so to an average taxpayer, so I can understand the reason for your comment. I am also making use of your statement so I can clarify this to the other readers of these comments. As you seem to have a number of questions about the District and its finances, I again urge you, and any other citizen of the District, to pick up the phone and call me (314-644-0919) or email me (nlmitten@gmail.com) with your questions or comments. I always believe that it is better for a citizen to have accurate and complete information before commenting on such important and vital issues.

Nelson Mitten

Director and President

MRH School Board

Mr Mitten,

No way in my statement did I say the props were the same. I did mention in prior about both props mentioning class size.

(I don’t think there is much difference now then last years when Prop K was passed.) My bad for leaving out much difference (IN ENROLLMENT) since the passage of prop K. I also didn’t say this to be fact.

Very well said, Tracy

Harold, I believe she means Prop Y, the school tax increase from 2010, and yes, the transformation over the past five years has been pretty amazing to watch. Harold, have you actually stepped foot in any of the schools in recent memory? If you haven’t, I would encourage you to stop by one of them and talk to an actual administrator. Have them show you around the building when school is in session.

It was 5 years agi

Interesting and sadly predictable that the flier sent out by the Councilman’s No “committee” at this late date is devoid of any information other than simplistic scare bullets about tax rates. No addressing of any of the issues raised by supporters of the proposition. No discussion of the details or reasons for the Prop. (And this style of argument from a Council member? Disappointing.) No acknowledgment of what’s been done to improve the school district (and make it attractive to new residents, which in turn has increased enrollment, which in turn necessitates new facilities and budget…because these things don’t happen in a vacuum).

And the kicker: the typically myopic bullet about “spending per student in Mid-County,” which completely (perhaps intentionally?) ignores the context of funding in mid-county, the demographics and tax base of MRH, and the *value* and *impact* of investing in students.

As a resident for over 20 years who has seen the positive and almost unimaginable transformation of the school district, I’ll happily vote yes; I hope that fear and online tax rants don’t interrupt this transformation which has been great for our kids, our community, and our society.

When my wife and I moved to Maplewood 20 years ago, MRH was in crisis. Maplehood and Mentalwood were the common nick names for the place but houses were cheap and we fully expected to send our kids to private school if we even chose to have kids.In the in between years, drastic improvements happened thanks to school leadership, parent involvement, and some tax rate increases. So we sent the the kids first to the ECC, then Elementary, and now will be sending them to the middle and high schools.

Without a doubt, the rise of Maplewood was spearheaded by the improvement of the school district. I will vote yes on Y and ask the current no voters to reconsider.

Our property rates may be higher but assessed values are lower. If you want to provide equal support to the school system you need the higher rate.

In the past six years, the number of students attending MRH schools has exploded. There was no way for the old budget to keep meeting the demand that this many students have placed on the system. Obviously, more money is necessary. In an effort to put off asking for more money, cuts were made in excess of a million dollars. Overall, in St. Louis County, spending is down per student. So are all measurable standards of success. The same is not true for MRH. Our schools are thriving. They are winning awards. They are making property values rise. Mr. Cerven’s mailer was short. It did not explain what was actually going on in our schools. It was misleading. He should be ashamed of himself for failing to stand by our kids. He should be especially ashamed for failing to actually understand an issue before championing against it.

I know I am in the minority around here by all the signs up, but I was already planning on voting NO. There is some kind of disconnect with the school district and their spending. I think it is very telling that the elementary schools are bursting at the seams, but yet the middle and high school do not. As a 20 year resident, this pattern has been the same for at least a decade. The district does a good job with the younger kids, and those are the families who support & push for these increases. I’d be willing to bet that the majority of residents with the signs up for it have babies and kids under 13. Yet for some reason, as their kids age, those same families either move out or pay for private school and those left behind are stuck with the tax bill. Maplewood residents tax rate is higher than Clayton! That mailer just stated clearly — throwing money at this district is not fixing it’s problems.

Julie, I agree with you.

That’s why I and many others voted for a multi million dollar Prop K, to increase the EEC so some children could be moved there from the Elementary School freeing up space to relieve the over crowding. They are still talking, over crowding among other things. So the millions we are spending from Prop K is not going to do what it supposed to?

The amount of kids entering our schools keeps growing. People are moving to our neighborhoods with their kids because of our great schools. The Prop K money could not possibly cover the student influx over the past few years.

Harold, can you tell me what Prop K supported, please be specific. You seem to be an expert so tell me how this tax level (Y) is different from the bond issue (K) that was voted on last year.

I’m no expert by any means. Everyone on here keeps talking about over crowding, and smaller class sizes. On Prop K and Prop Y

This is what prop k was to do about over crowding.

The bond issue on the April 7, 2015 ballot, known as Proposition K, includes $6.1 million for projects that will provide $1.75 million for land acquisition, site development and other related costs, and $4.35 million for construction of a new eight homeroom Preschool and renovation of the existing Preschool into a Kindergarten Center.

Proposition K would provide more space by creating a new preschool center, moving kindergarten to the current preschool space, and bringing the second grade class back to the Early Childhood Center.

Prop Y To preserve our level of academic excellence, maintain small class sizes, retain our highly qualified teachers, and fulfill the goals set by our community, the Board has voted to place Proposition Y, an operating tax levy, on the April 5, 2016 ballot. Proposition Y calls for an additional $.55 per $100 of assessed valuation of property. Of the $.55, $.10 will be dedicated to capital improvements and the remaining $.45 to general operating expenses.

Thnaks

Yes, Prop K funds the building of space, but Prop Y covers paying the STAFF that allows us to use that space to alleviate overcrowding. It’s that simple. You can’t successfully have one without the other. Otherwise you get space but can’t pay staff, or you hire staff but have to classrooms for them to use. That is the difference and that is why Prop Y is needed.

Harold,

Your lengthy and numerous comments on both this issue and the previous Prop K issue suggest a deep distrust of local government, specifically the MRH school board. I’m not sure where this disdain comes from, nor is it any of my business. However, I hope that whatever issues you have can be resolved without it negatively affecting the public education system in our community.

Harold, you keep saying that last year you voted in favor of Prop K. However I find that at about this time last year, someone named Harold had more than one post here with very negative comments about Prop K. Are you the same Harold? You certainly sound like the same person because you both make the same arguments and use the same language. You claim to be quite astute at doing your research and checking your facts. I suggest you take a moment to consult Webster’s for the definition of hypocrite. Now since you have lied about this fact, I have to discount your other arguments. Thank you for helping me become a YES vote on Prop Y. I hope others come to same decision.

I am very excited to have a child at MRH Middle School. They teach using an Expedition Model. As a school, they went to the Smoky Mountsins to study ecosystems and endangered Hellbenders salamanders. Next week they will be going on an overnight to Greensfelder Park and work on team building and problem solving skills. Fights at our upper level schools are almost unheard of compared to other neighboring schools. There has not been a single fight at the Middle School this year. Obviously, the kids are buying into the model of the school as a community. Their test scores are also some of the highest in the county. Comparable to Webster Groves, Parkway and Kirkwood. I couldn’t disagree more with your assessment. I have to think that maybe it’s because you don’t have a child at school currently. My daughter loves school. She feels as though she’s an integral part of her community. She gets great grades. She tests high on standardized testing. I am a parent of an older child of our school system and I couldn’t be more pleased. The same is true for any other parent I have talked with. This was not the case with our schools ten years ago. Ten years ago, the school board and administrators made a pledge to make fundamental changes to our school system. Those changes have worked. Our schools are amazing. i think you need more up to date information.

As a 30 year residents, and you being a long term resident I hope you have gone to visit the schools at their open houses and a few programs and games like I have. As being a long term resident you seem to truly informed about the district. I disagree this is not the pattern over the decade. What I have found is there are groups that are stuck on bashing the district and using broad statements like yourself. I am a resident who does not have children in the district but have found way to inform myself. I have seen a eye sore turned around, I have talked to my neighbors who have children and support and confidence on the district has grown. No not everything is perfect, but it is far from what it was 20 or even 10 years ago.

As someone with children in the district, I thank you for your consideration and your vote. It’s really, really appreciated. This is an amazing place to live, and I credit so much of it to the school district and to the people who support it.

I received much more clarification from the Maplewood and Richmond Heights City Council members and school board member Mr. Mitten who did their best to explain financing issues, where they intersect, where they do NOT intersect, and the crossroads the communities face. Nothing in Mr. Cerven’s mailer attempted to come close to that. I do not know how the Prop Y’s campaign can be accused of scare tactics; telling the truth about the connection between school performance and property values is well-supported. I have appreciated the respondents who ask questions without demeaning the student population and the hard-working parents. An elected official should, at the very least, be responsive to overtures from his fellow council members to discuss and problem solve with other elected officials who have a stake in the community he professes to care about.

No on Y! Enough is enough.

With all due respect, I don’t think it’s scare tactics. I think it’s math. More and more families with young kids have moved to the district. MRH administration has already cut close to $1M. If they cut any more, no one will want their kids to go to school here. But that is exactly what will happen if prop y fails. We won’t have money for seed to table, home visits, kindergarten technology, some high school sports, various clubs and activities, on and on…plus class sizes go way up and we can’t pay our teachers anything close to what they’re worth. It’s just math. We need more money to run the school because of increased enrollment.

Dave Cerven is a coward for not meeting with school officials and Dave (the person commenting above) is simply narrow minded and has already decided on how he is going to vote for this proposition no matter what. That mailer is full of so many twisted truths it’s on the verge of being labeled as “misleading”.

VOTE YES FOR PROP Y and get these narrow minded individuals who don’t support education to move to a non-progressive city somewhere else.

Rick,

You want to talk misleading. How about on the ballot the wording is (The Operating Levy of the District per one hundred dollars of assessed valuation is estimated to be $4.7869). This is true to a point, but misleading. The mention The Operating Levy, from my understanding they are leaving out part the tax levy for debt service. This is why our Actual Tax Rate for 2015 for the MRH School District is already at a rate of $5.5869.

Our Actual tax Rate in 2010 was $4.9876, this is higher then the figure they are stating.

Very easy to check our tax rate. Just go to this link click the drop down and go to Maplewood Richmond Height. You can check tax rates back as far as 2005. https://revenue.stlouisco.com/Collection/YourTaxRates.aspx Also while checking it out look at the past two years and see if you notice any roll back MRH Tax Rates. I think you will see an increase every year.

2015 $5.5869

2014 $5.5500

2013 $5.4100

2012 $5.3203

2011 $5.2610

2010 $4.9876

There is no way our Actual Tax Rate is going to go down to $4.7869 from $5.5869, if Prop Y is passed. Why not tell the voters what the true Actual Tax Rate will be?

Harold – I asked MRH Board Member Nelson Mitten about the ballot wording, and he sent me this:

Ballot language is specified by state law. The Prop. Y ballot language was reviewed and approved by legal counsel for the District and by the St. Louis County Board of Elections before being placed on the ballot. In response to the inquiry (my inquiry) we again contacted the Board of Elections which again confirmed that it is correct.

Doug, I agree with that.

Things are always worded on ballots as to try and sway votes in their favor. Really nothing new.

I am merely point out the fact that it don’t give the whole picture. I think voters need and have the right to be fully informed.

He does not say it’s not TRUE. No matter if it is by State Law, approved by legal counsel, and the Board of Elections, changes the fact that it is misleading what are Actual Tax Rate will be if passed.

If someone is reading the Prop information at the ballot box for the first time, we have other issues. The polling place is not where the voter should be making up his mind. Each of us has a responsibility to read and understand what we are voting for, not during voting, but before we even walk to the polls.

I also appreciated the straightforward information in the card I got today. I am voting no. I also took off my MRH bumper sticker..

I’m sure this happened.

WOW ! Why did you do that?

I also appreciated the straightforward I formation in the card I got today. I am voting no. I also took off my MRH bumper sticker..

Good. Why don’t you put a “For Sale” sign in your yard why you’re at it.

A community member- just because something has a few sentences on it doesn’t mean it’s straightforward. The issue is complex. I fear Mr. Cerven’s “straightforward” mailer is trying to appeal to those who don’t fully understand the issue.

I got the same mailer today and threw it in the trash where it belongs.

I received mine in today’s mail. Very informative. Short and to the point without all the scare tactics the other side is using. I’ve been to two meetings, read all the literature on the pro side, and I am still dead set against the increase. Good job! Vote NO! on prop Y.

Dave, I wish you would reconsider. You may or may not like choices that the school board has made over the years. Frankly, its not about them. It’s about the children in our district. I think we can all agree we want every child in our community to have the best education that we can provide for them. Dave, taxes stink, they always go up. It’s a hardship, I know. Nobody likes paying more money year after year. But I’m committed to this district and I’m willing to do my part financially to ensure that the children in our community get the best from us. I would hope you do, too.

You seem informed, why are you voting no?