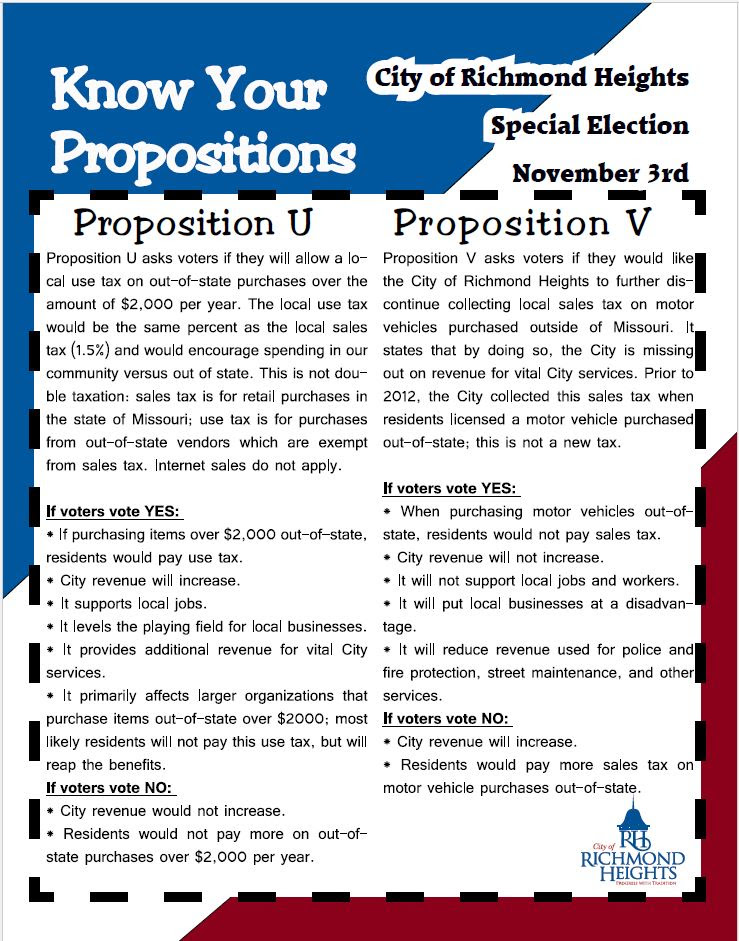

Residents of the City of Richmond Heights will be asked to vote on two propositions on November 3. The city has explained the propositions in a flyer.

The explanations below are from the city.

Proposition U asks voters if they will allow a local use tax on out of state purchases over the amount of $2,000 per year.

The local use tax would be the same percent as the local sales tax (1.5%) and would encourage spending in our community versus out of state.

This is not double taxation: sales tax is for retail purchases in the state of Missouri; use tax is for purchases from out of state vendors which are exempt from sales tax.

- If you vote yes, residents would pay use tax when purchasing items over $2000 per year from out of state vendors; City revenue would increase, thus supporting vital services, like police and fire, street maintenance and more.

- If you vote no, there would be no tax increase on out of state purchases; City revenue would not increase.

Proposition V asks voters if they would like the City of Richmond Heights to further discontinue collecting local sales tax on motor vehicles purchased outside of Missouri.

It states that by doing so, the City is missing out on revenue for vital City services. Prior to 2012, the City collected this sales tax when residents licensed a motor vehicle purchased out of state; this is not a new tax.

- If you vote yes, residents will not pay local sales tax when purchasing motor vehicles outside of Missouri; City revenue will not increase.

- If you vote no, the City will collect the sales tax on out of state motor vehicle purchases again; City revenue will increase, thus supporting vital services, like police and fire, street maintenance and more.